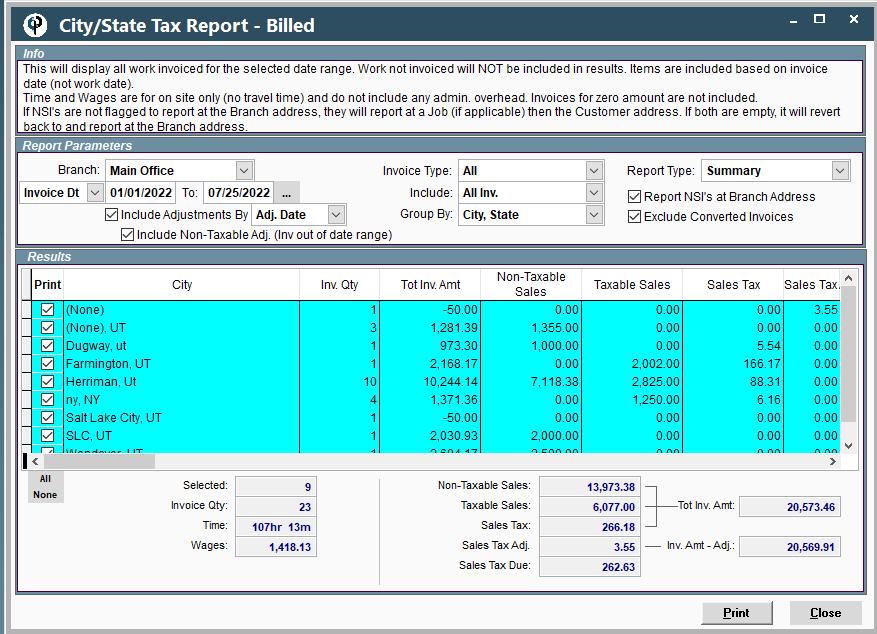

Items are included based on invoice date (not work date). Time and Wages are for the on-site time only (no travel time) and do not include any admin overhead.

Invoices for zero amount are not included.

If NSI's are not flagged to report at the branch address, they will report at a Job, then Customer address. If both are empty, it will revert back to and report at the branch address.

Run the City/State Tax Report by going to Reports-> Tax Reports-> Sales Tax Invoiced-> Select parameters

FAQ:

Q: Sales Tax Adjustment is not showing up

A: It depends on when the tax adjustment was. For instance, If the invoice was in September and the adjustment was in September, when you run the report for September, we just decrease the taxable sales.

If you the invoice was in September and you did the adjustment in October, when you run the report for just October, you will see the sales tax adjustment as you now need to get reimbursed /credit for it as you already paid that tax.