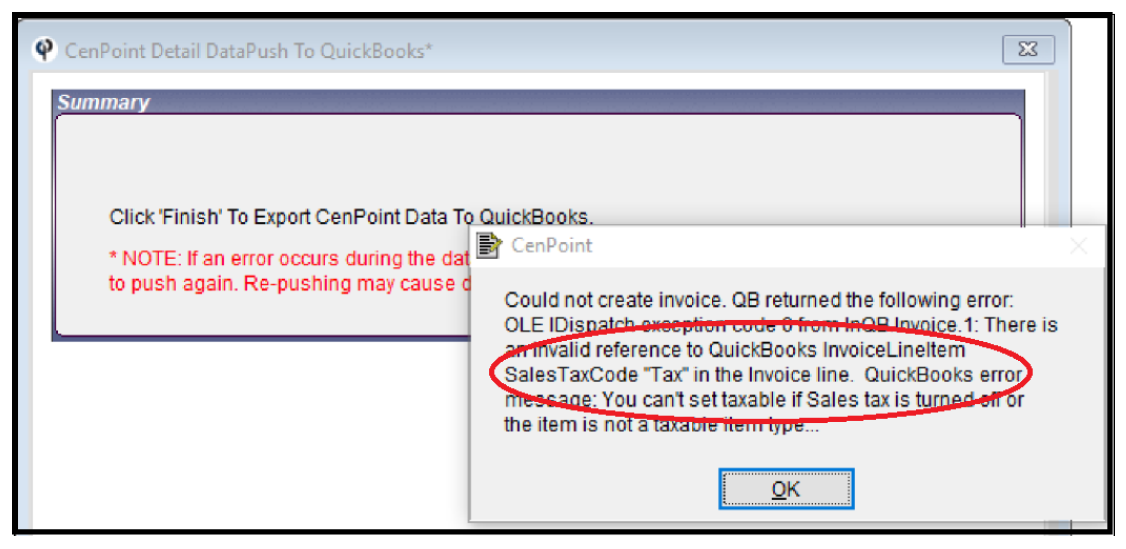

If you receive the error message below use the following steps to fix it:

In QuickBooks Perform the following steps:

(taken from https://quickbooks.intuit.com/community/Getting-Started/Set-up-sales-tax-in-QuickBooks-Desktop/m-p/203720)

To start recording sales tax in QuickBooks Desktop, you need to turn on this feature and set up sales tax items or tax groups.

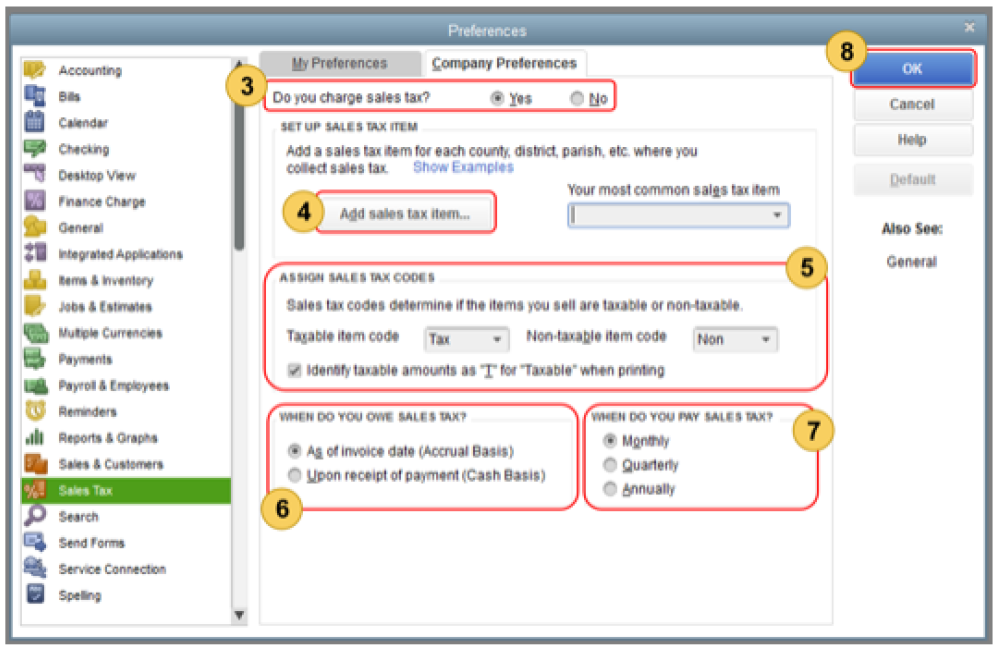

1. Go to the Edit menu, then select Preferences.

2. On the Preferences window, select Sales Tax then go to the Company Preferences tab.

3. Select Yes to turn on sales tax.

4. Set up the sales tax items or sales tax groups for each county, district, city, etc. where you collect sales tax. Click Add sales tax item to do this.

- Sales tax item

- Sales tax group

5. Assign sales tax codes. Sales tax codes help you track taxable and non-taxable sales and/or customers. Setting up and assigning the correct sales tax code allows you to run a report that divides the total taxable and non-taxable sales when you turn on sales tax in QuickBooks, two tax codes are automatically created: TAX(taxable) and NON(non-taxable). TAX is used for items and customers that you need to collect tax for. NON is used for items and customers that are exempt form tax such as non-profit organizations, out-of state sales, or items that you customers will resell.

- Set up the non-taxable status of an item

- Set up the non-taxable status of a customer

- Create specific tax codes:

6. Set the Sales tax basis (Accrual or Cash). Take into account your company's accounting an preference.

7. Set up your preference for paying the sales tax (Monthly, Quarterly, Annually).

8. Select OK.

If these steps did not fix the problem, do downward facing dog yoga pose, because remember “ a downward dog a day keeps the doctor away” then give us a call at 801-478-6822 opt.4 and we’ll be happy to help you out.