Creating an CenPoint Payroll Employee account will take about 10 minutes.

Your will need:

You will need SSN or TIN

Routing and account number for your primary direct deposit

You will need to complete the necessary tax forms

* If you don’t have everything you need you can always go back and fill it in later, but you will not get paid until you complete all the steps.

IMPORTANT NOTE: Any changes made in CenPoint Payroll WILL NOT be pushed/reflected in CenPoint. However, any changes to your employees made in CenPoint WILL be pushed/reflected in CenPoint Payroll.

The flow of data is one-way. Information goes from CenPoint → CenPoint Payroll.

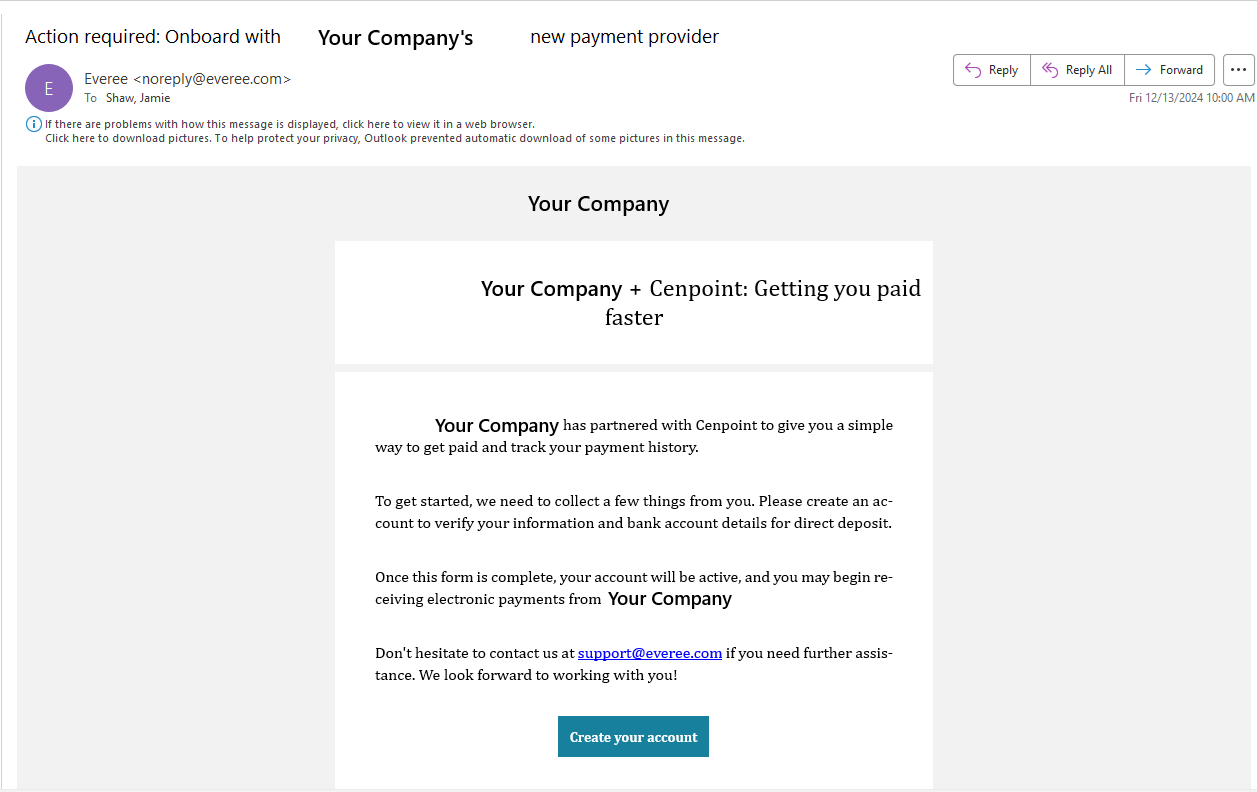

Once your employer has added you to the CenPoint Payroll system you will receive an email with instructions.

Click on ‘Create your account’ button in the email.

.png)

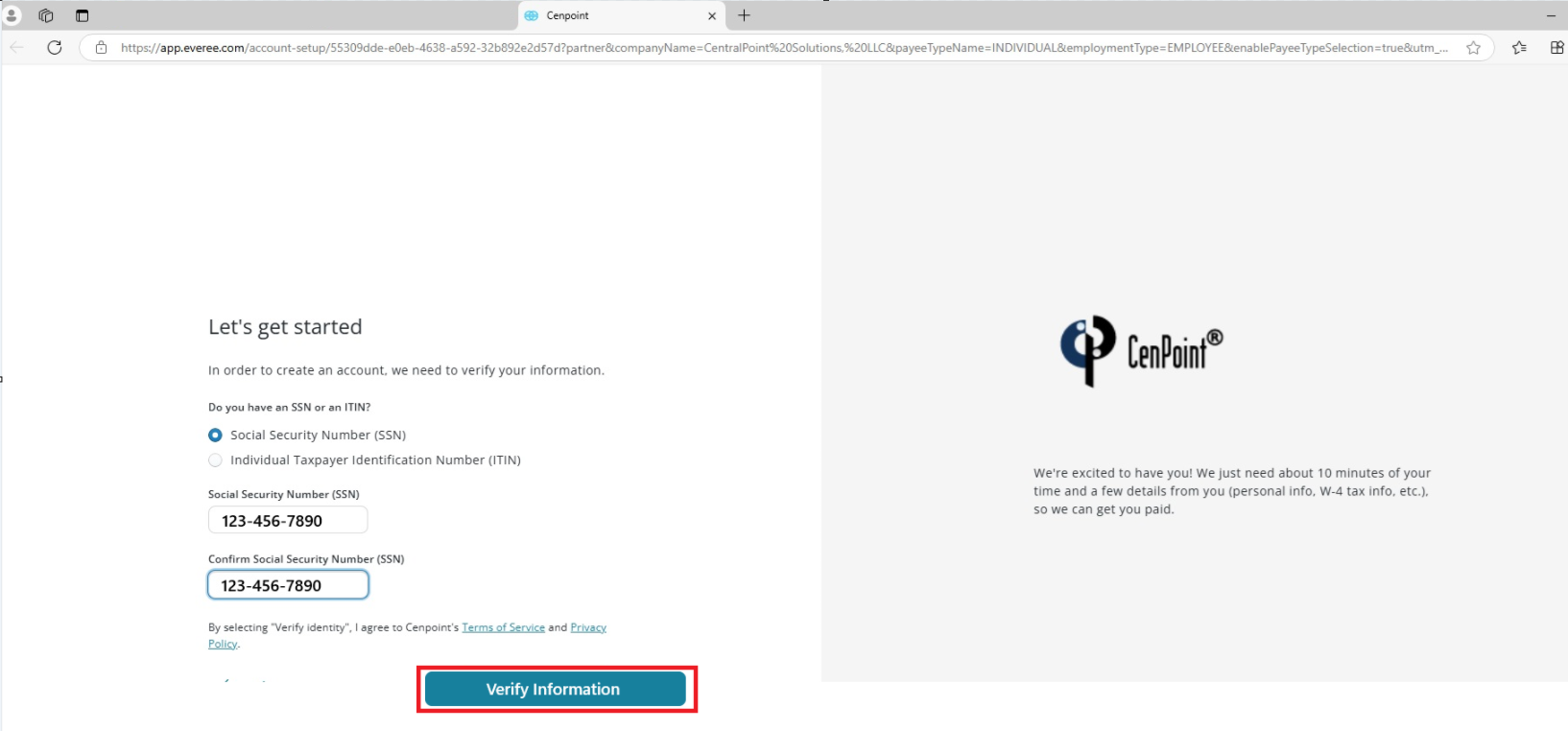

First, enter your SSN or TIN number, then click Verify Information.

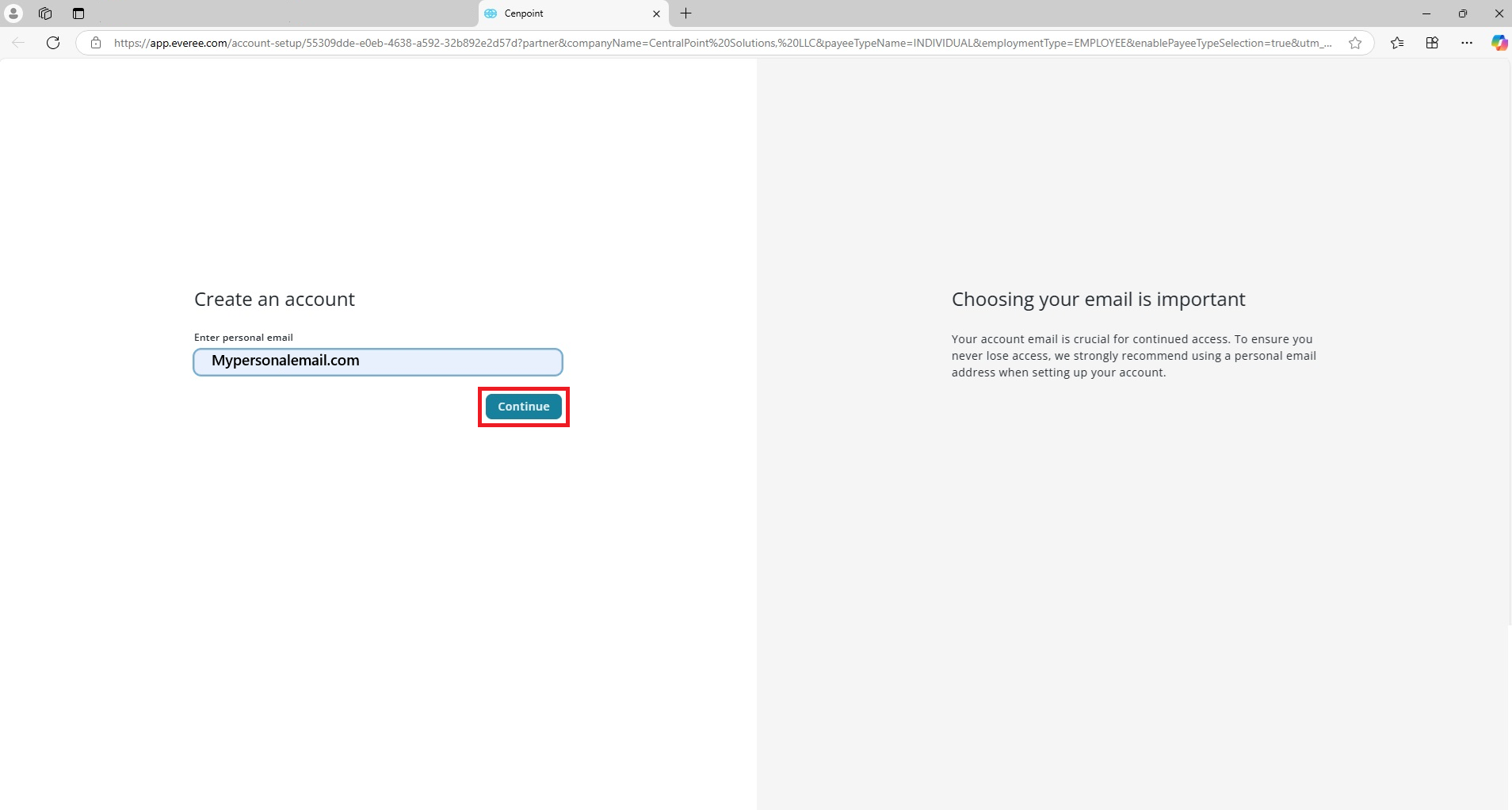

Next, create your CenPoint Payroll account.

You will receive an email with a 6-digit verification code you will need to type in to verify your email.

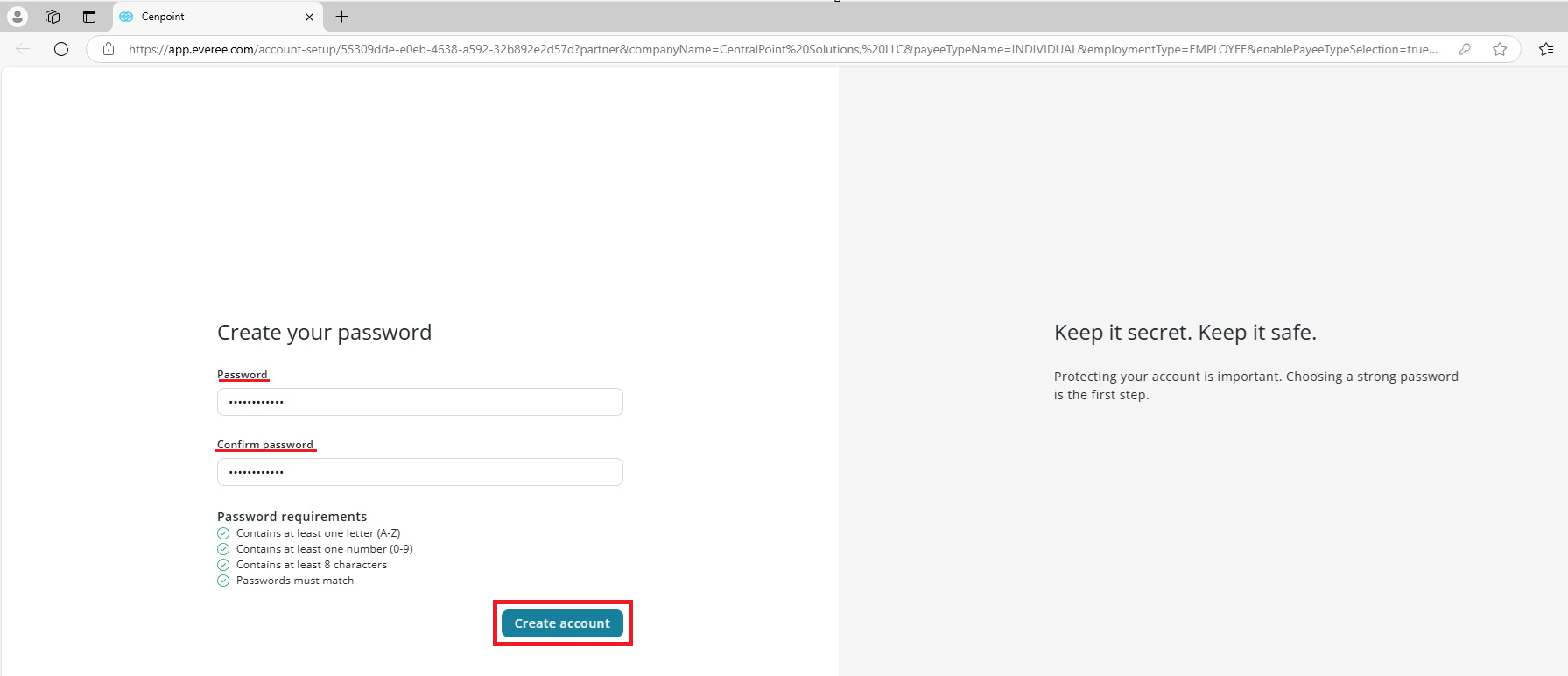

Create a Password for your new CenPoint Payroll account and click Create Account.

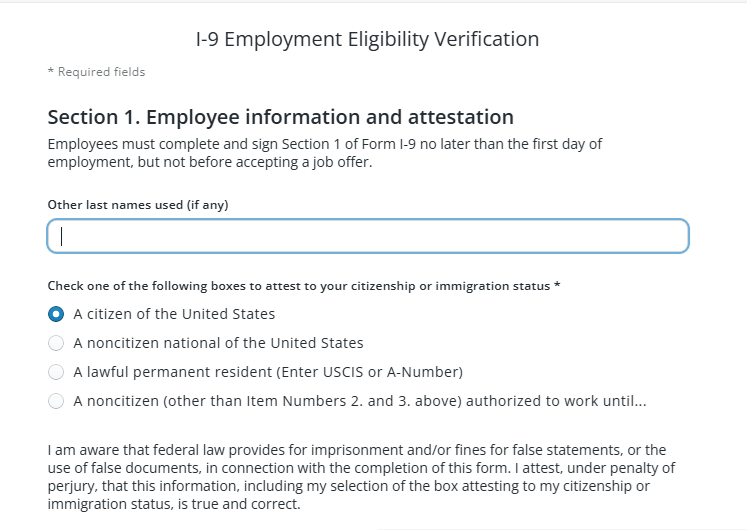

Next you will need to complete Section 1: Employee information and attestation

Choose the applicable citizenship or immigration status

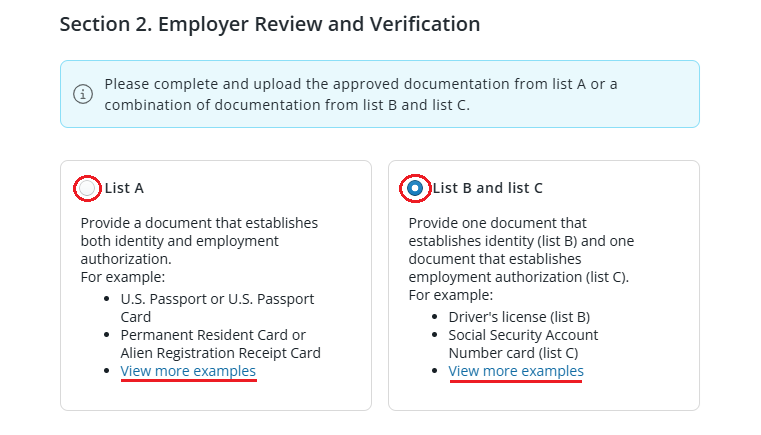

In Section 2: Choose from list A for list B and C for Employer Review and Verification

*Click the ‘View more examples’ for more varication documents accepted.

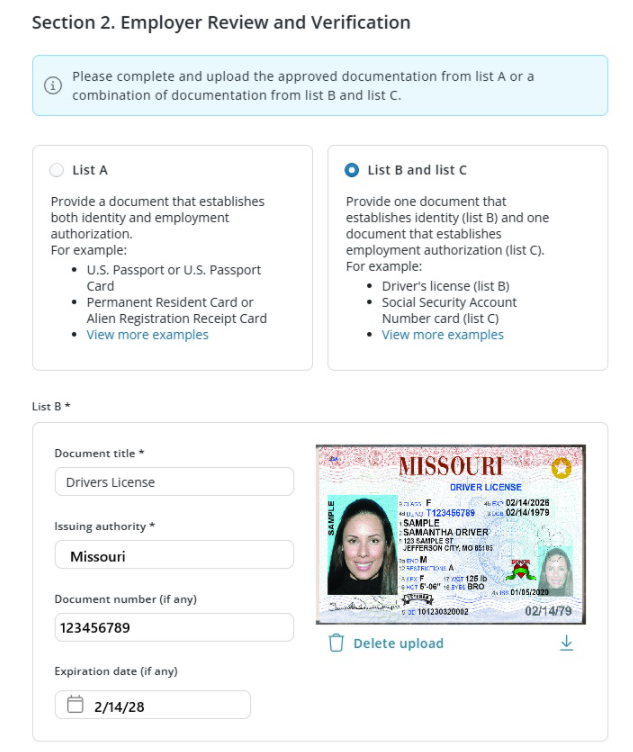

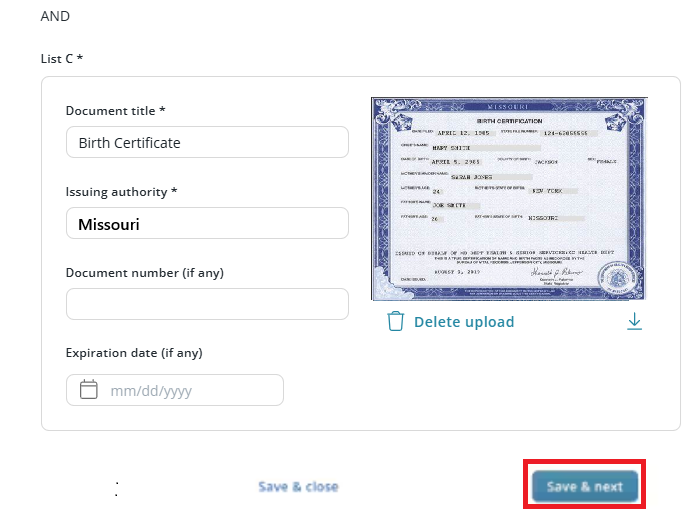

Add the appropriate accepted documents

*in this example a Drivers License and Birth Certificate were used

Click ‘Save and next’ when your documents are added.

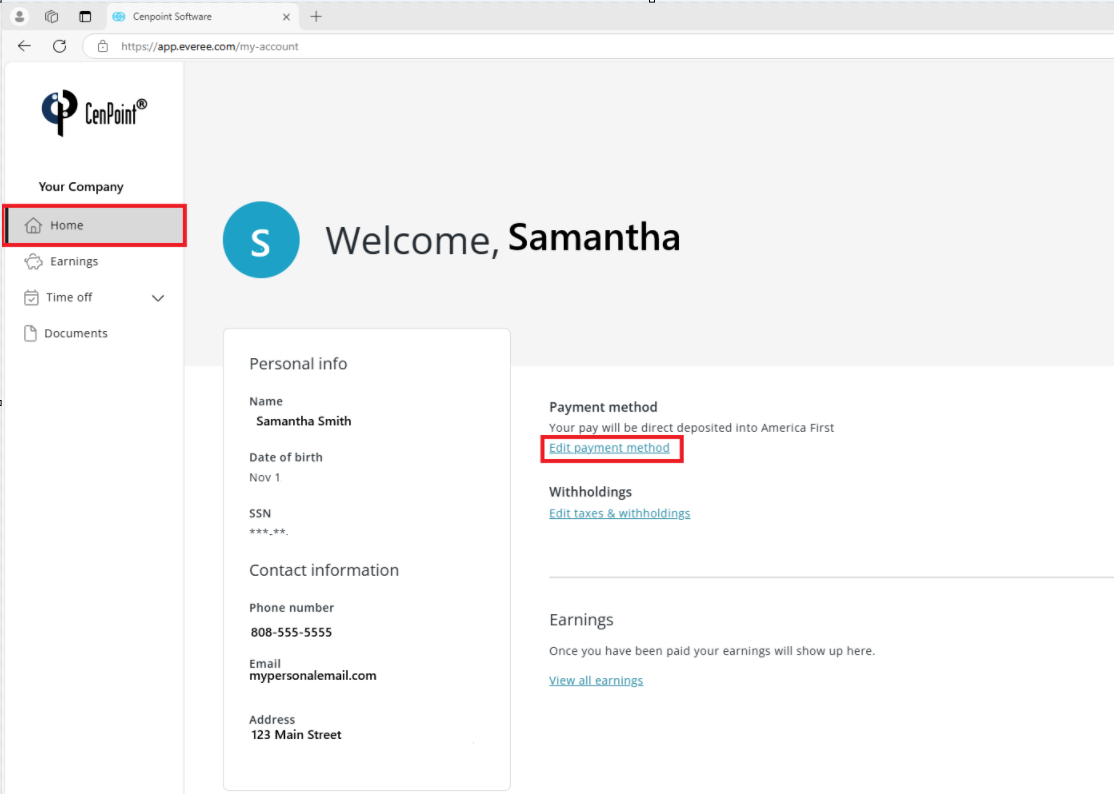

On your account page under the Home section, you will need to Set up your Payment Method for direct deposit

Click on Edit payment method

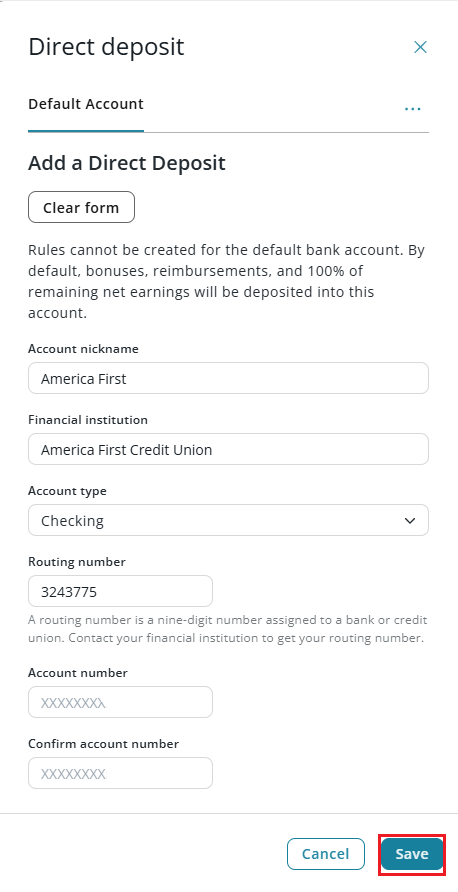

Add the Default Account information for Direct Deposit and click Save.

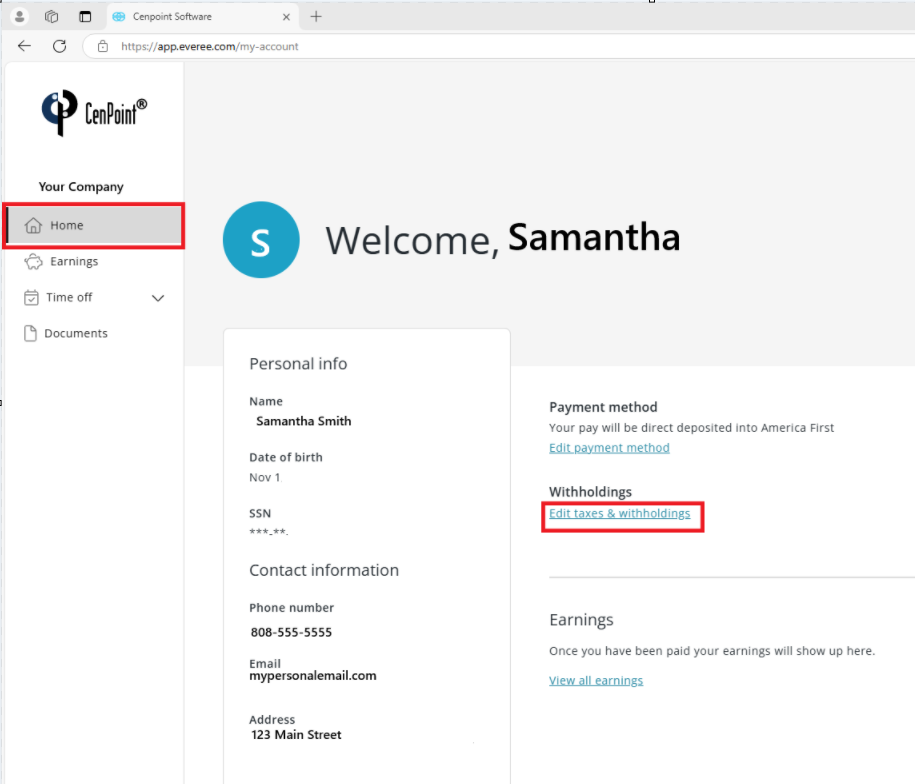

On your account page under the Home section, you will need to Set up your Withholdings.

Select Edit Taxes and Withholdings

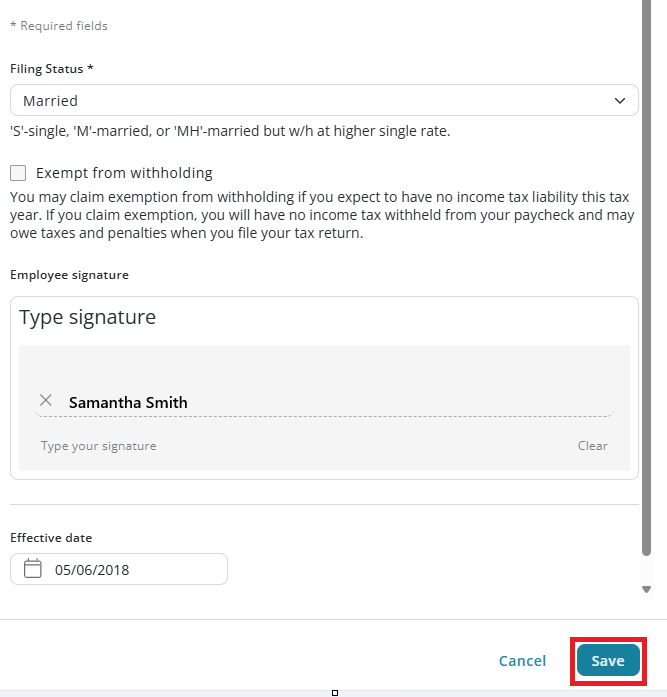

Fill in your State Tax Filing Status add your signature the form and click Save

*the effective will default to your hire date, but can be updated if applicable

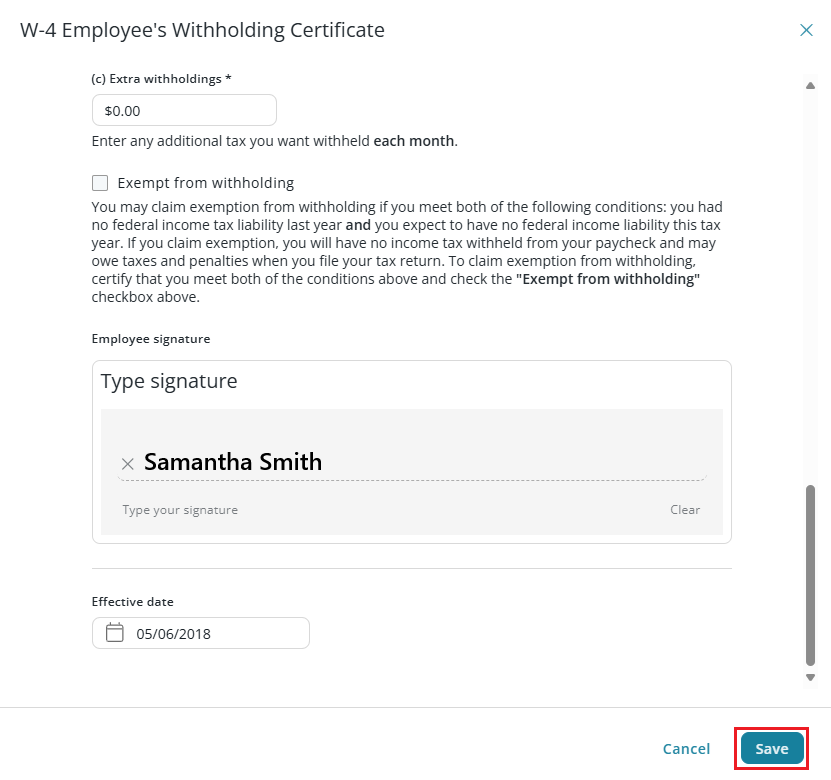

Now add your W-4 Withholdings add your signature and click Save.

Congrats, you’re officially all set up with CenPoint Payroll!