Article Description:

This article will walk you through how to upload payroll (and deductions calculated by CenPoint if needed). Time and rates should already be reviewed/approved in CenPoint before doing this.

Inside of CenPoint, go to: Reports → Time Cards & Payroll → Review Tech Time

Make sure you are looking at the correct pay week and all times are approved.

Click on Export… → For All Techs (or Current Tech) → More Options → Everee .xlsx file

.png)

This may take a minute or two. Once it is done you will have up to two (2) files

File 1: Named something like Payroll_20250127_20250202.xlsx

File 2 (Only if Deductions are setup under the users profile): Named something like Payroll_Deductions_20250127_20250202.xlsx

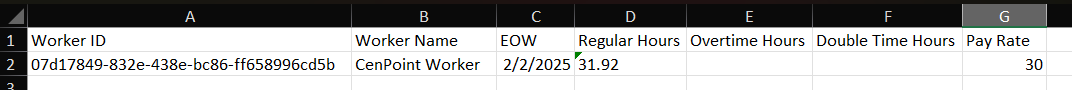

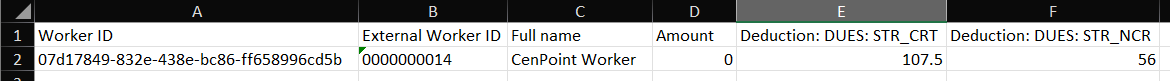

You files will look something like this:

Payroll_20250127_20250202.xlsx

Payroll_Deductions_20250127_20250202.xlsx

Note: You will need to upload these files inside of CenPoint Payroll. We are currently working to streamline this with an API experience so the need for files goes away but we are not quite there yet.

Inside of CenPoint, go to Reports → Time Cards & Payroll → CenPoint Payroll

Sign in to your CenPoint Payroll account. Note: This is currently available only through Portal. (One is unable to access it on the Desktop)

Upload the time / rates for the week

Inside of CenPoint Payroll:

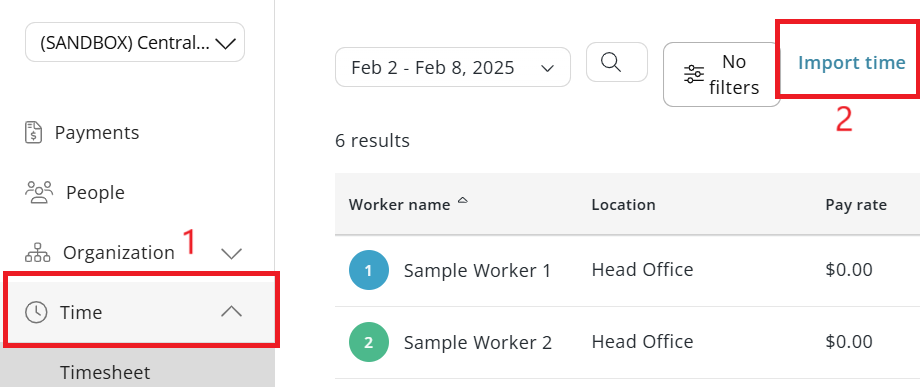

Click on Time → Import Time

Make sure your pay week is correct and then Browse to or Drag and drop the Payroll_20250127_20250202.xlsx you downloaded earlier.

Upload Deductions (Optional, skip to step 8 if you do not desire to upload deductions)

Note: This step only applies if CenPoint is calculating gross deductions for you for something more complicated than CP Payroll can handle. If this is the case, CenPoint will calculate the gross deductions you have specified for each user and that will be reflected in the user’s net pay. You are still responsible for cutting a check to where those deductions go (i.e. Union Dues, write a check to the union)

Inside of CenPont Payroll:

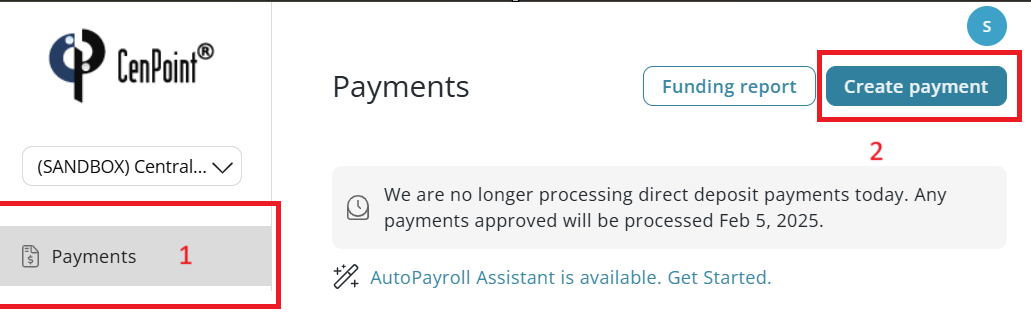

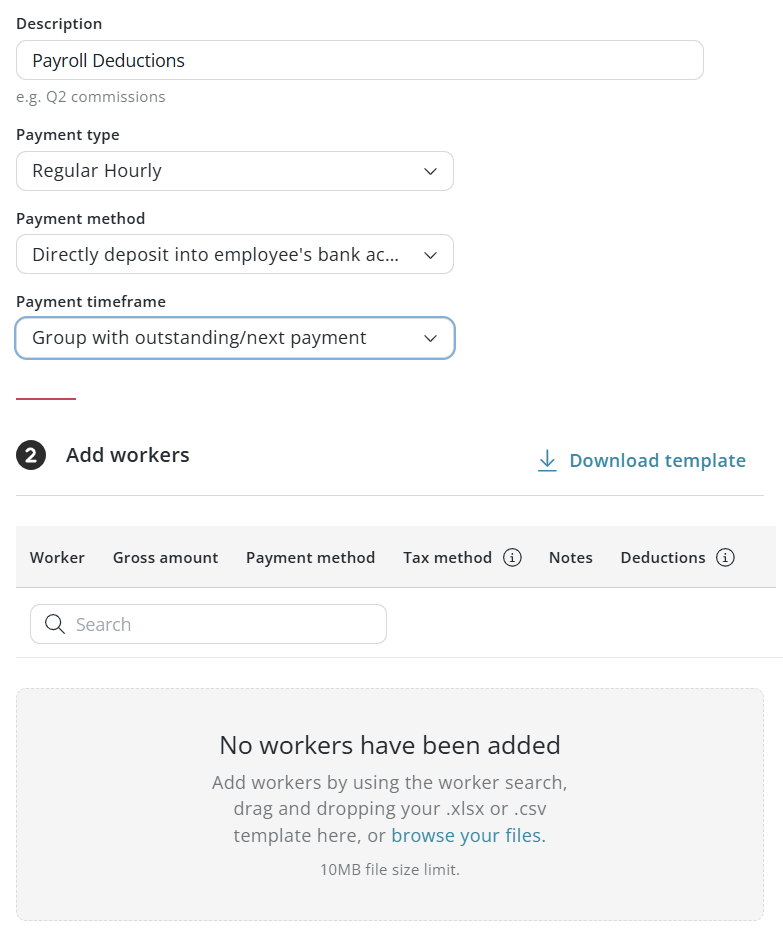

Click On Payments → Create Payment

Fill in the information as follows (description can change if you want)

Browse to or Drag and drop the Payroll_Deductions_20250127_20250202.xlsx you downloaded earlier.

Click On Create Payment

Process Payroll

Click on Payments on the left again and then review your payroll. Click ‘Process’ and use the following steps on each payment you would like to make.

.png)

The ‘Total to fund’ amount is what will be taken out of the account to make this payment. Note: Please make sure you have sufficient funds in this account before finishing processing this payment.

(Optional) Click ‘View Details’ to see a report with a greater breakdown of information about this payment.

Click ‘Approve’ to finish processing this payment.

.png)