This is useful if you have a task that requires an excise tax instead of sales tax.

Multiple Tax Rates on Desktop

Tax Rate Names on Desktop

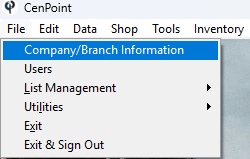

Go to File -> Company/Branch Information

Double Click on your Branch or select it and click Modify

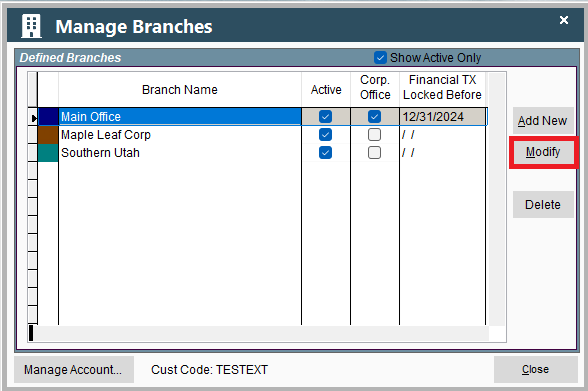

This will open a window in Portal so don't worry if it looks different than the rest of Desktop.

Go to the Misc 2 tab and add names to the Tax Rate(s) you will be using.

This is set at the Corporate Office level and not per branch.

Manage Tax Regions on Desktop

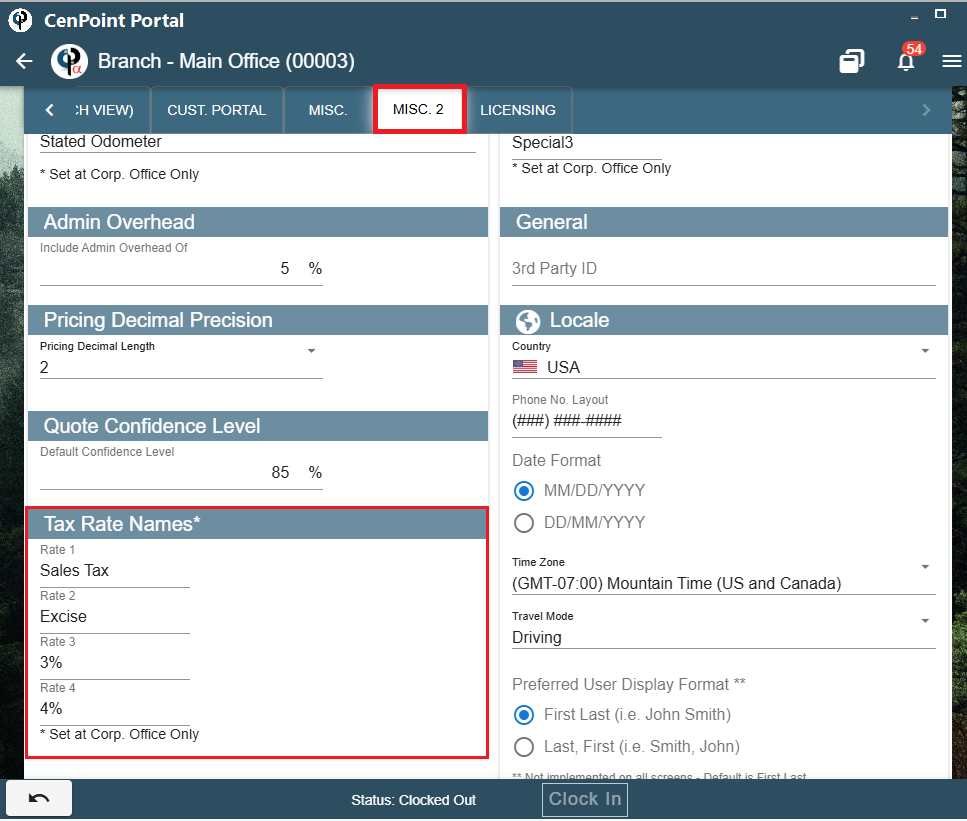

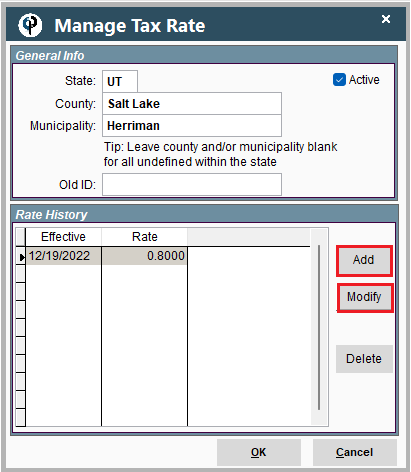

To add the new tax rate(s) to the Tax Region go to File -> List Management -> Accounting -> Tax Rates

Use the 'Add New', 'Modify', and 'Delete' buttons to edit your Tax rates based on Region.

*This will need to be done for each Tax Region that will be using the new tax rate.

.jpg)

In each Tax Region click 'Modify' to edit the Rate or click 'Add' to create a new one.

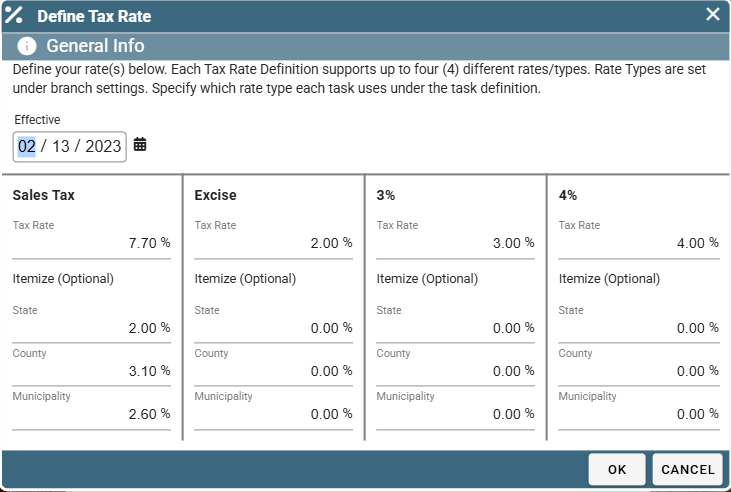

Select your Effective Date and add in the new tax rates. (the ones you named in Company Branch settings)

Click OK to save.

.jpg)

Specify Tax Rate on Task on Desktop

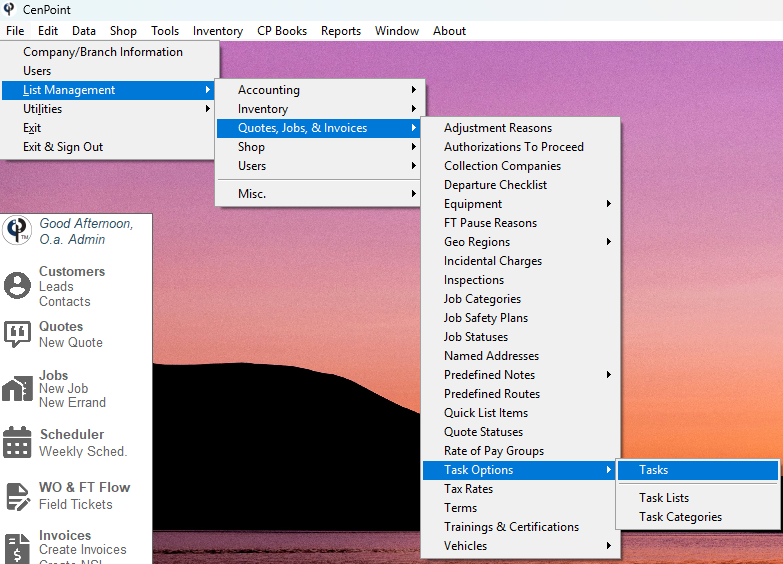

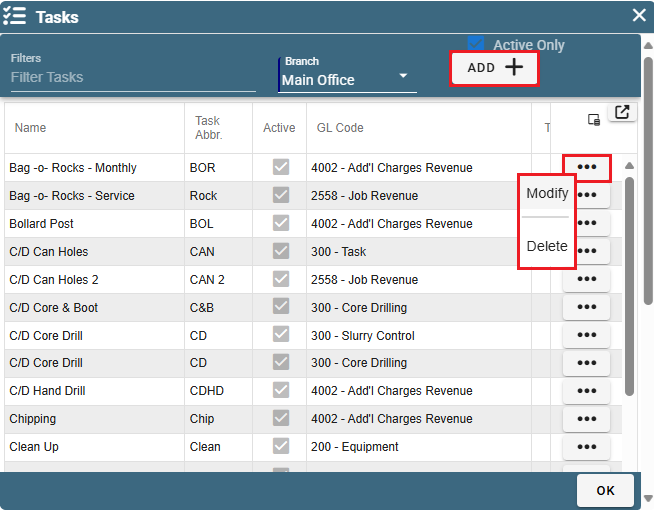

Add the tax rate to a task by going to File -> List Management -> Quotes, Jobs, & Invoices -> Task Options-> Tasks

Click 'Modify' to edit an existing task or click 'Add New' to create a new one.

.jpg)

Mark the task as taxable and select the Tax Type.

*This will need to be done to each task that will be using the new Tax Type

.jpg)

Add the task to a Quote or Job on Desktop

CenPoint will figure out what tax rate should apply to this job based on the address and/or what the tax rate is set to.

The rate will adjust the task tax rate based on what you set up on that Tax Region.

.jpg)

Tasks will default to Rate 1 unless specified on the task as a different rate.

NSI line items will also use Rate 1.

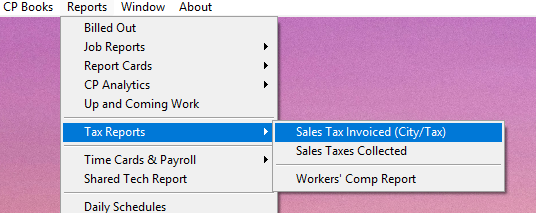

Tax report can be found by going to Reports -> Tax Reports -> Sales Tax Invoiced

Multiple Tax Rates on Portal

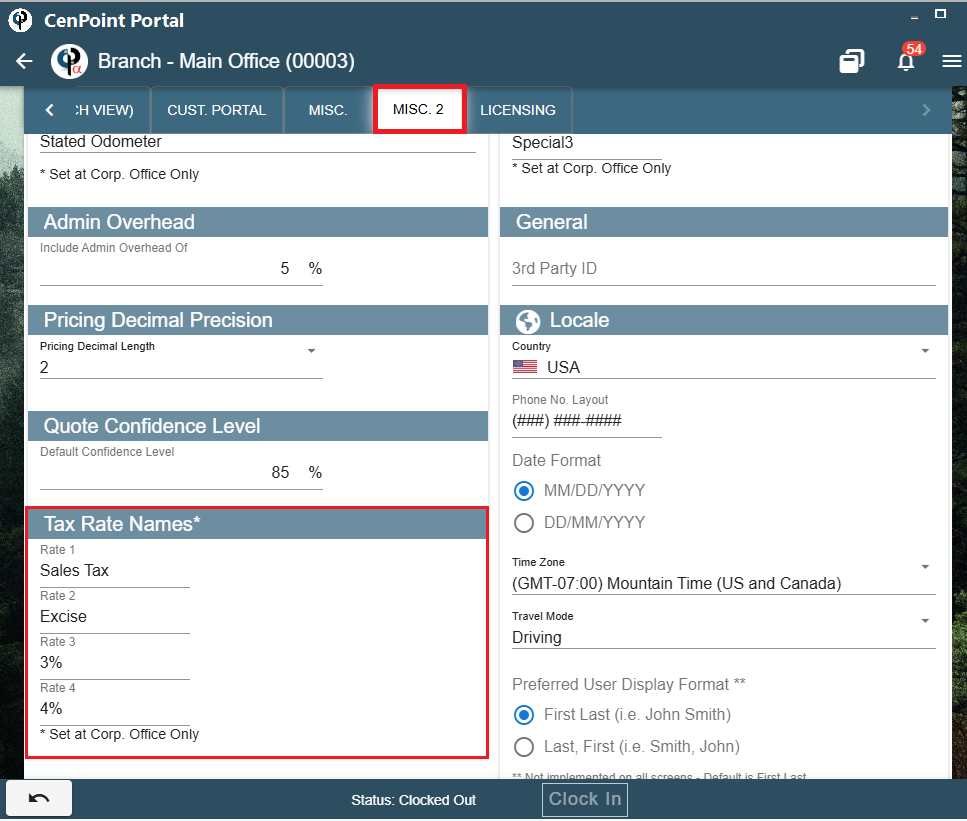

Tax Rate Names on Portal

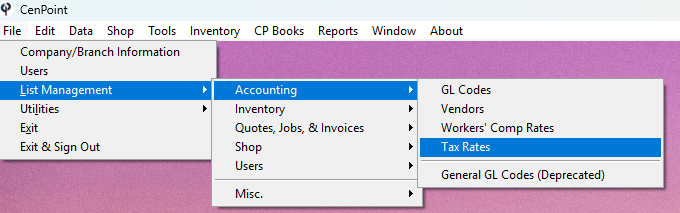

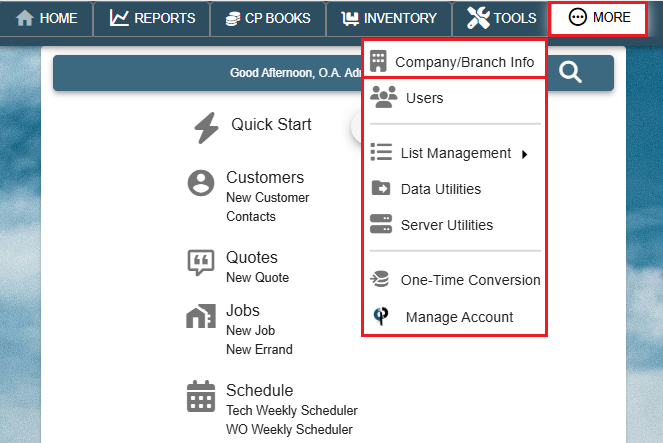

Go to More → Company/Branch Info

Then double click on your branch or select the Ellipsis → Modify

.png)

Go to the Misc. 2 tab and add names to the Tax Rate(s) you will be using.

This is set at the Corporate Office level and not per branch.

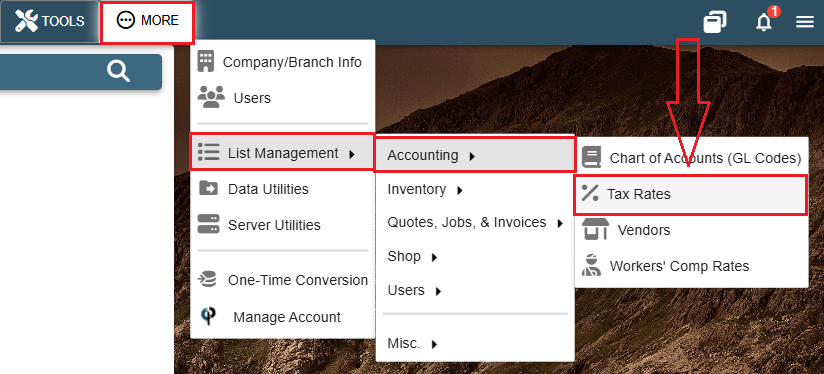

Manage Tax Regions on Portal

To add the new tax rate(s) to the Tax Region go to More -> List Management -> Accounting -> Tax Rates

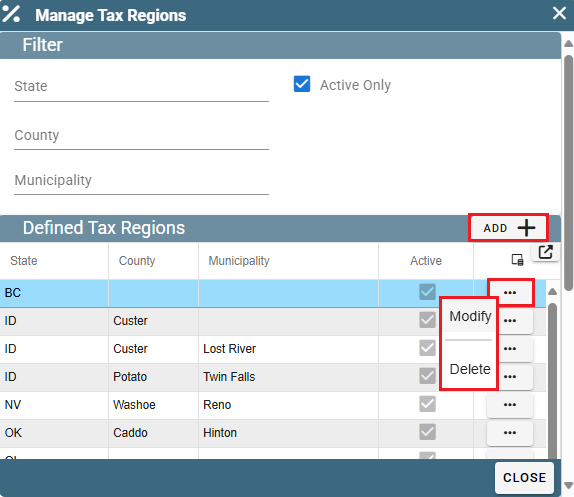

Click the 'Add' to create a new Tax Region. Click the Ellipsis -> Modify to edit an existing one.

*This will need to be done for each Tax Region that will be using the new tax rate.

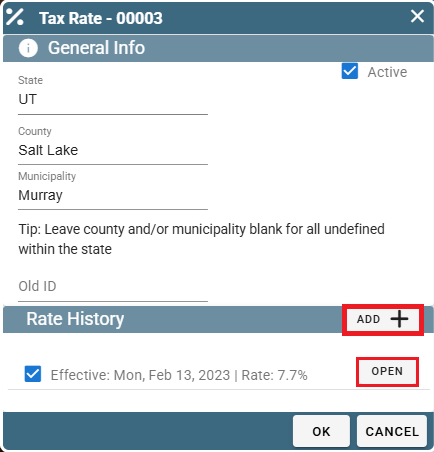

Select a Rate History and click 'Open' to edit it or click 'Add' to create a new tax rate.

Select your Effective Date and add in the new tax rates. (the ones you named in Company Branch settings)

Click OK to save.

Specify Tax Rate on Task on Portal

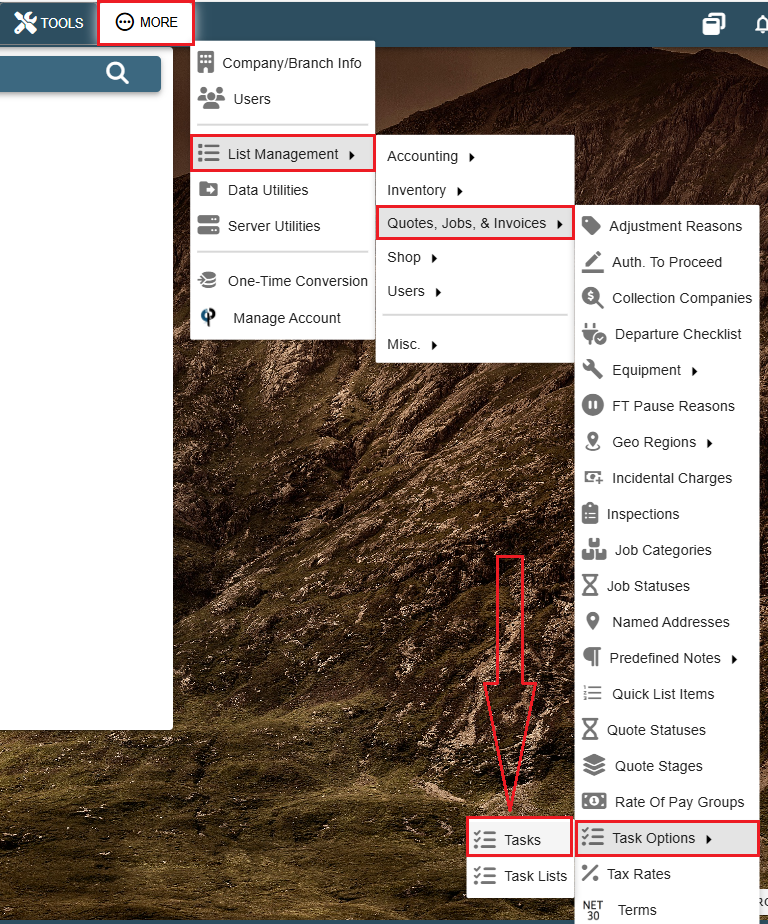

Add the tax rate to a task by going to More -> List Management -> Quotes, Jobs, & Invoices -> Task Options-> Tasks

Click 'Add' to create a new task.

Click the Ellipsis -> Modify to edit a task.

Mark the task as taxable and select the Tax Type.

*This will need to be done to each task that will be using the new Tax Type

.jpg)

Add the task to a Quote or Job on Portal

CenPoint will figure out what tax rate should apply to this job based on the address and/or what the tax rate is set to.

The rate will adjust the task tax rate based on what you set up on that Tax Region.

.jpg)

Tasks will default to Rate 1 unless specified on the task as a different rate.

NSI line items will also use Rate 1.

Tax reports are coming soon to Portal.