Setting Up Tax Rates by State, County, City, Etc.

Using Tax Rates in CenPoint

Tax Rates on Desktop

Tax rate by state, county, city on Desktop

See the following link for more information on how to set up tax rates by State, County, and City: Tax Rates

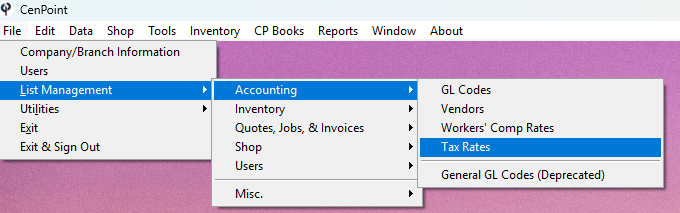

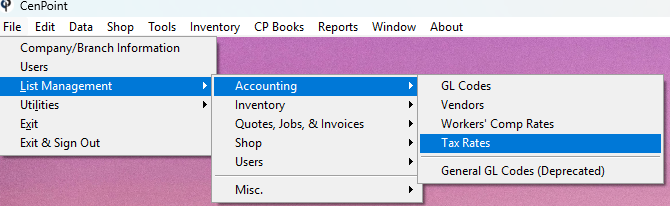

Go to File -> List Management -> Accounting -> Tax Rates

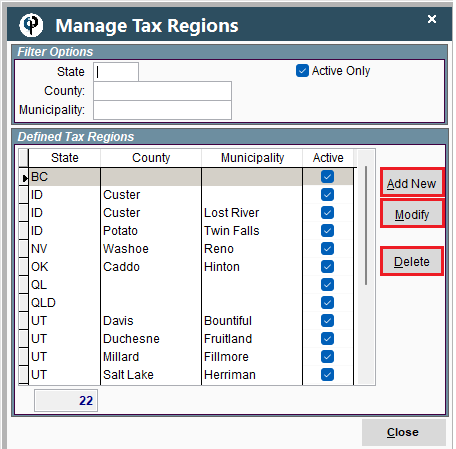

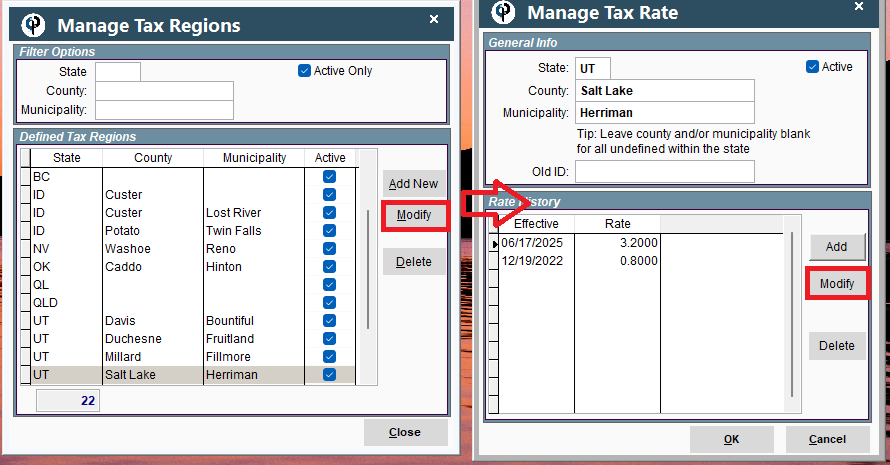

Use the 'Add New', 'Modify', and 'Delete' buttons to edit your Tax rates based on Region.

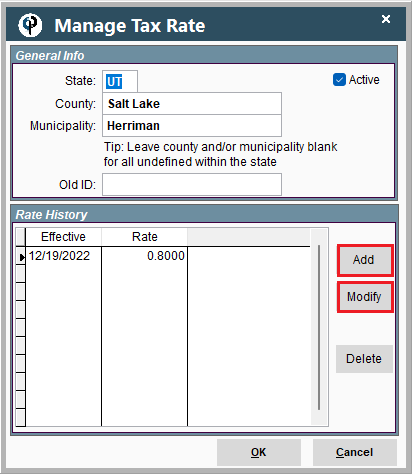

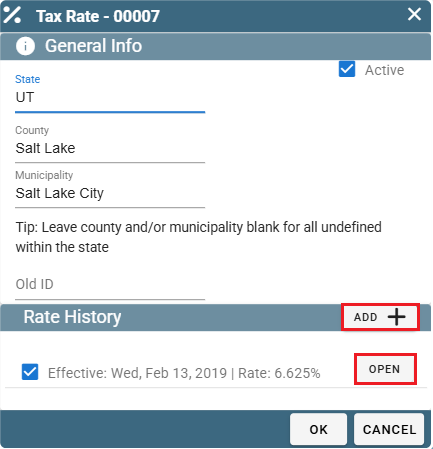

Inside the region click 'Add' to add a new Tax Rate.

Select an existing rate and click 'Modify' to edit it.

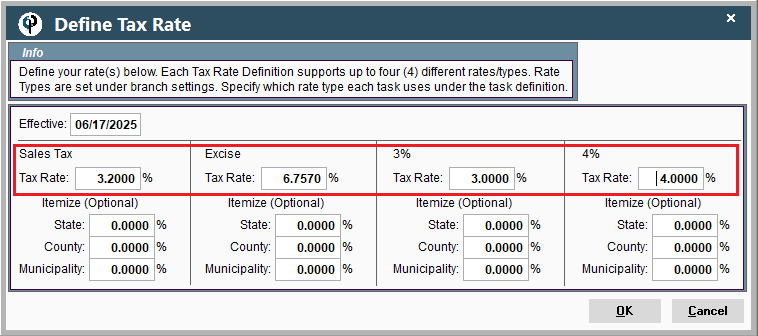

Please make sure all the tax rates are filled out so CenPoint can calculate taxes properly.

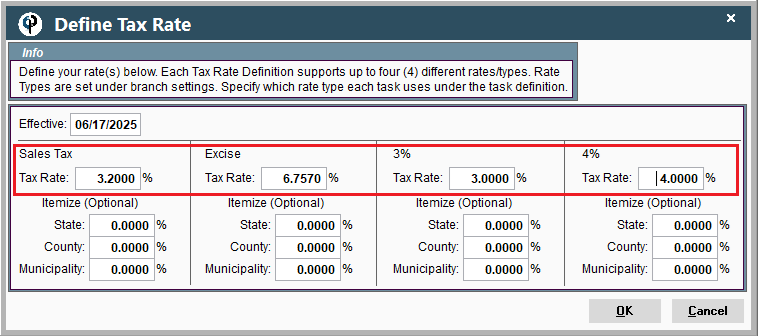

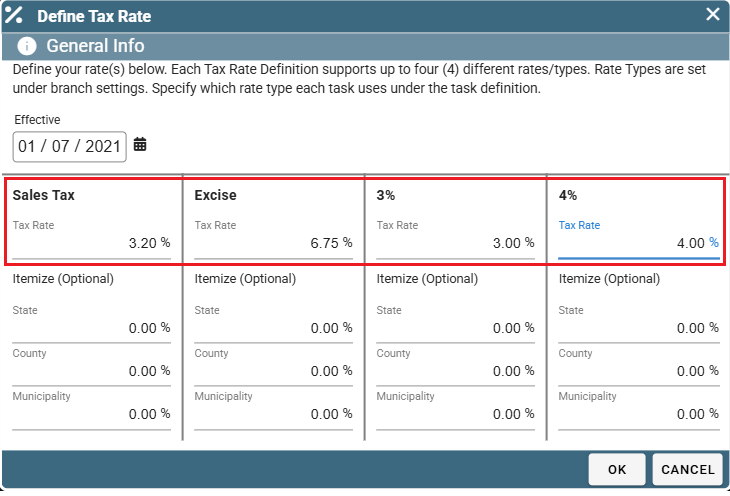

Enter in an "Effective" date to state when these rates will go into effect.

Delete Taxes on Desktop

Taxes can be removed off a job on a Task by Task basis.

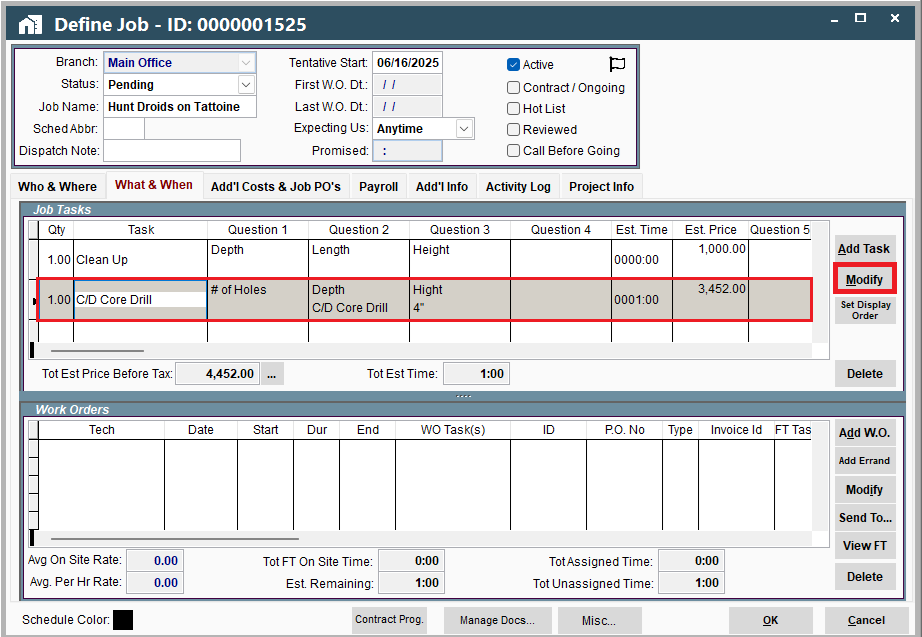

Inside the Job highlight a task and click "Modify".

Inside your Task uncheck the box labeled "Taxable".

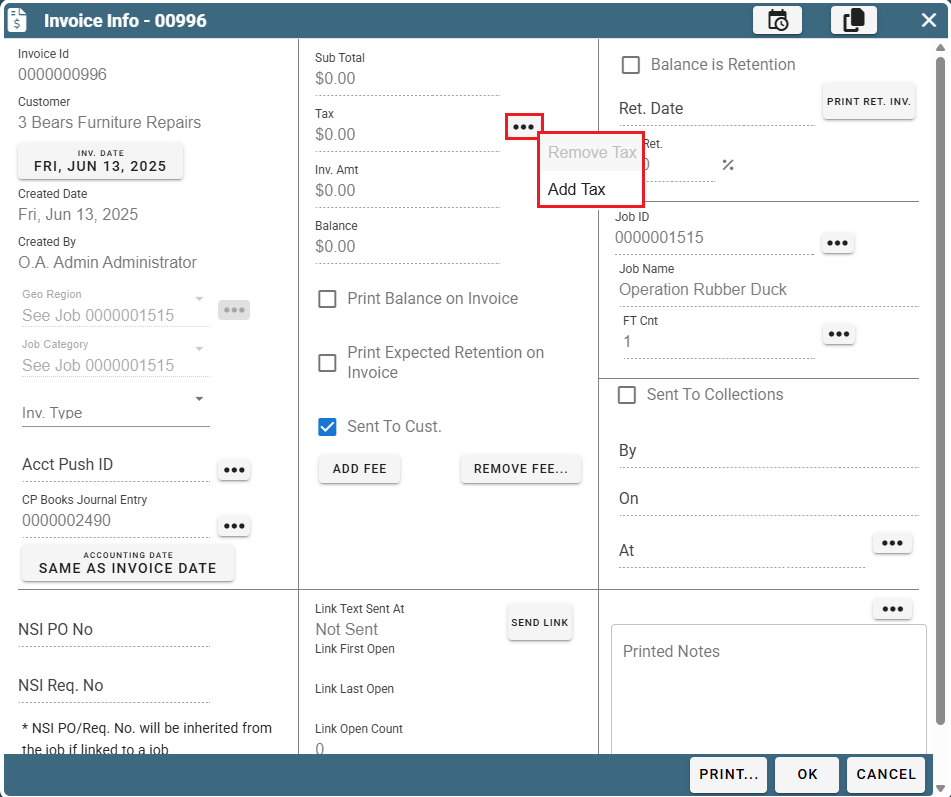

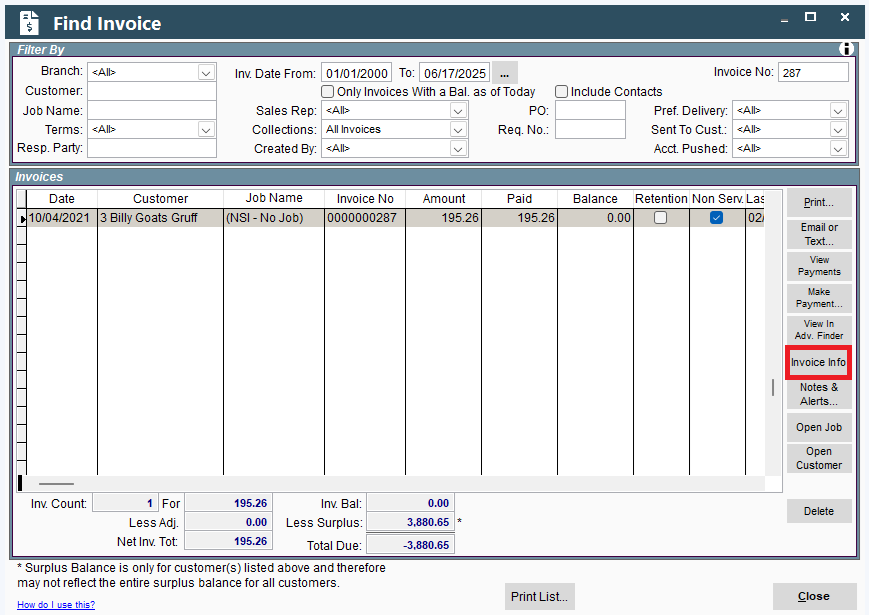

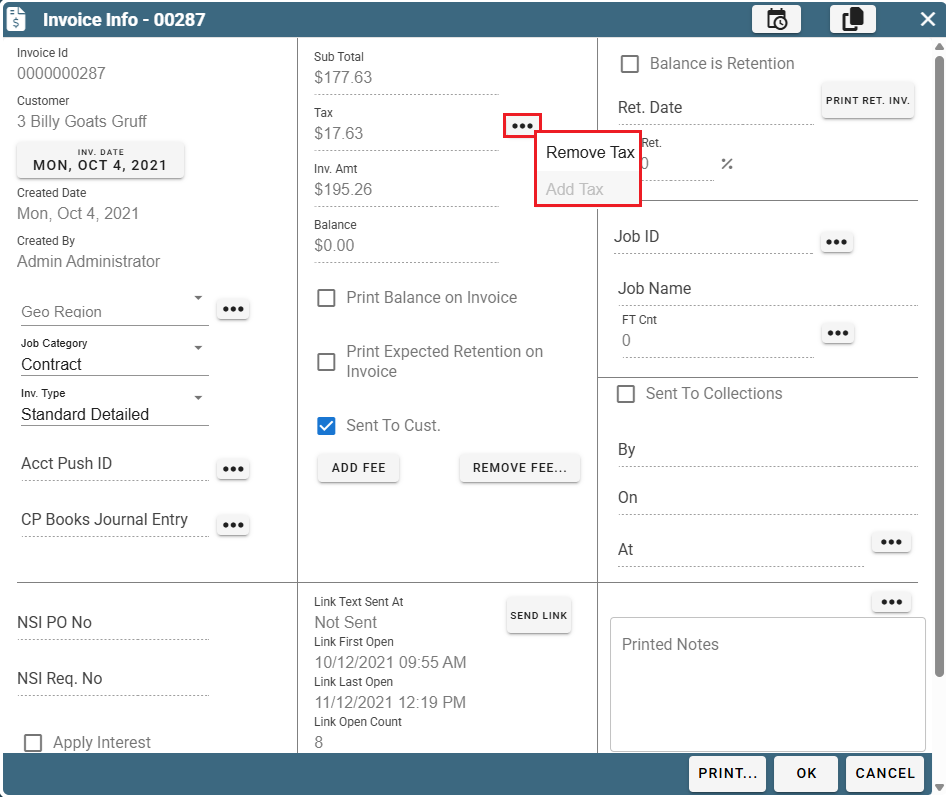

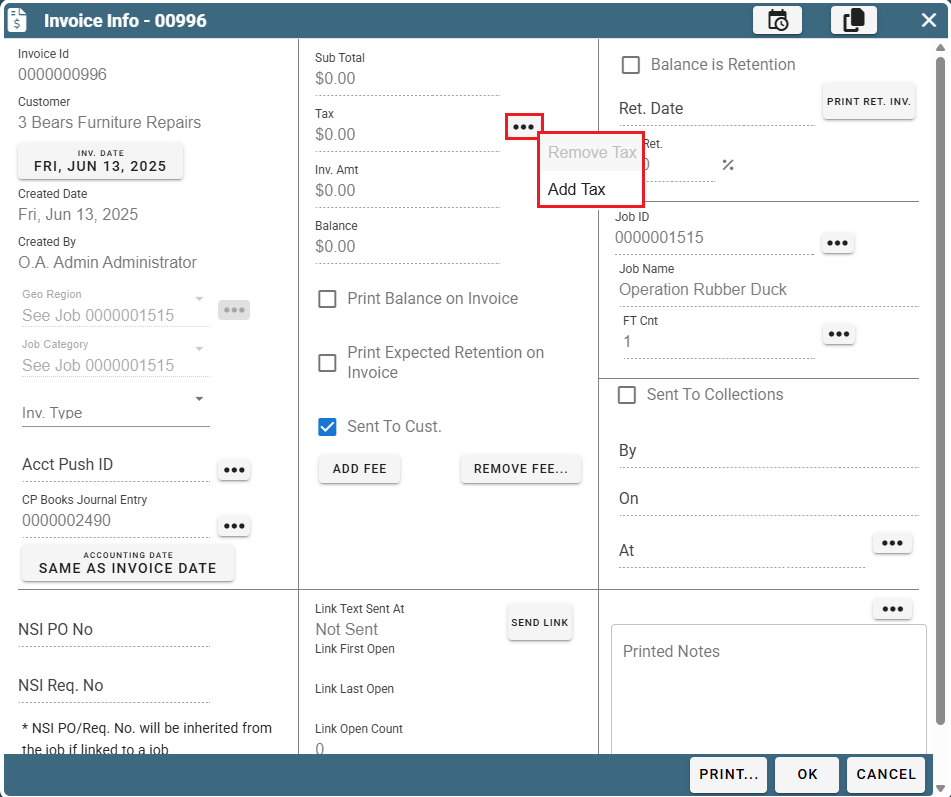

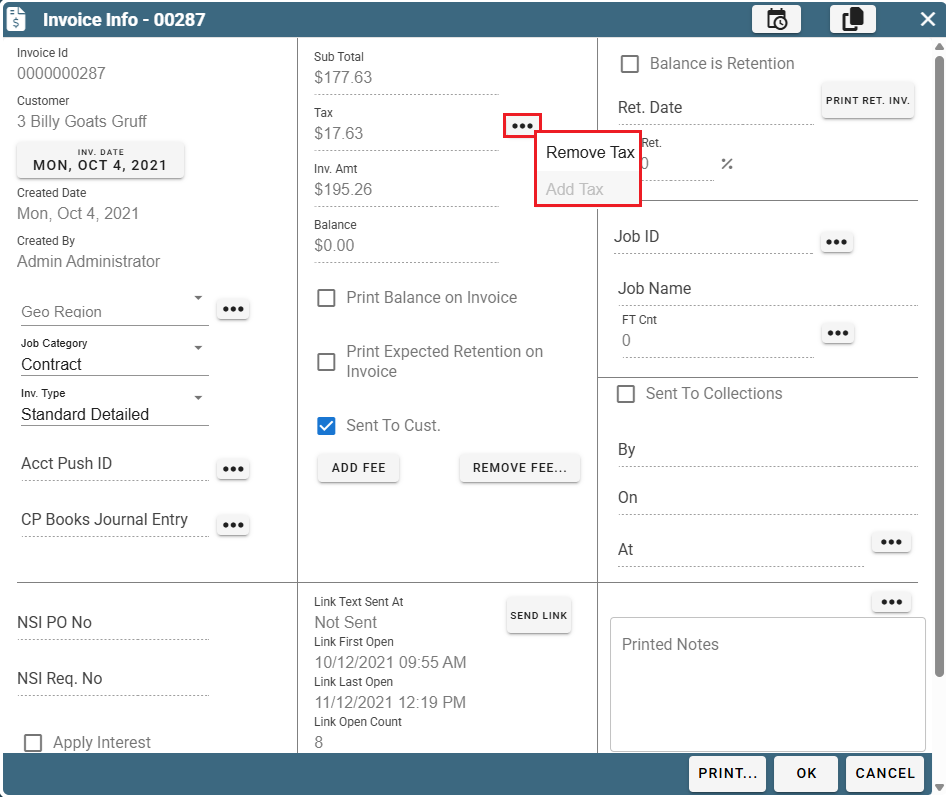

Delete Taxes off an invoice by finding your invoice and clicking the "Invoice Info" button.

Click the Ellipsis to the right of where the taxes are displayed to Add or Remove Taxes.

Missing Taxes on Desktop

There are several different reasons that taxes may not appear on the job.

1. Customer is marked as Tax Exempt.

2. Task assigned to a Job might not be marked as taxable.

3. Job may not have an address.

4. Tax Region may not have a defined tax rate for the tax rate the Task is assigned to.

If it is not one of the above-mentioned areas, you can still add tax from the Invoice Info window.

Information on how to do all of this is mentioned below.

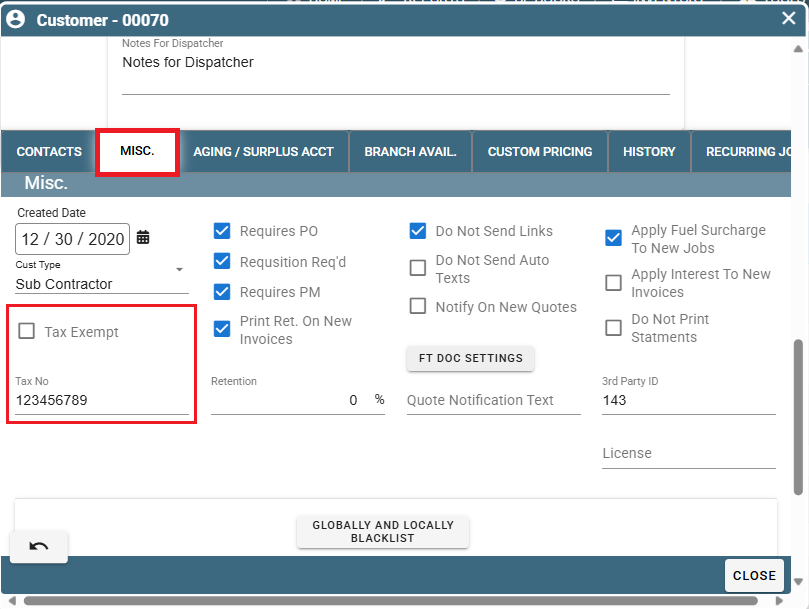

Customer Marked as Tax Exempt

Select the customer, go to the General Info -> Customer Info -> Misc. tab, and confirm that the Tax-Exempt checkbox is NOT marked. If it is marked, taxes will not want to appear on a Job for that customer.

.png)

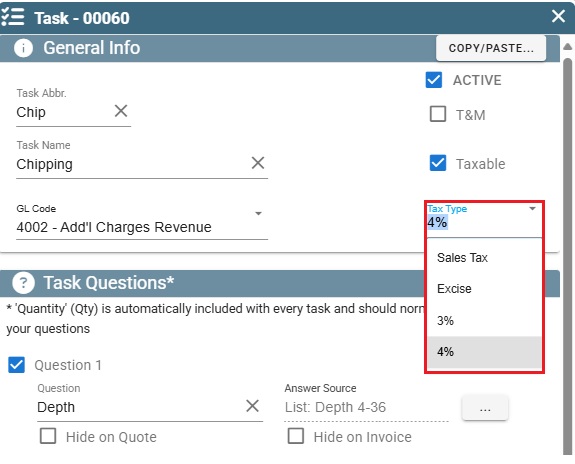

Tasks not marked as taxable

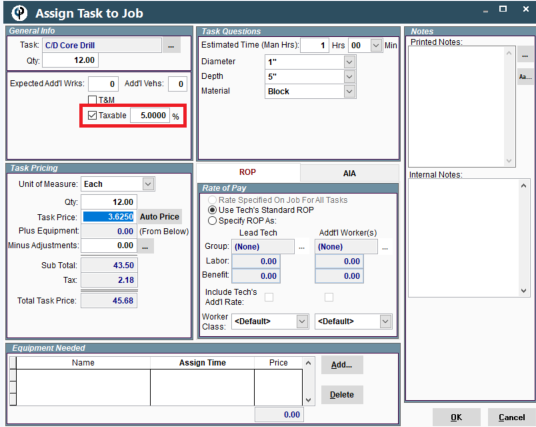

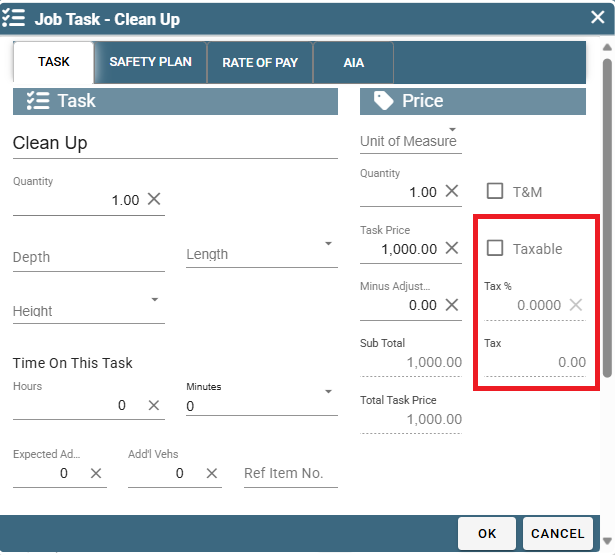

The task on the job may or may not be marked as taxable.

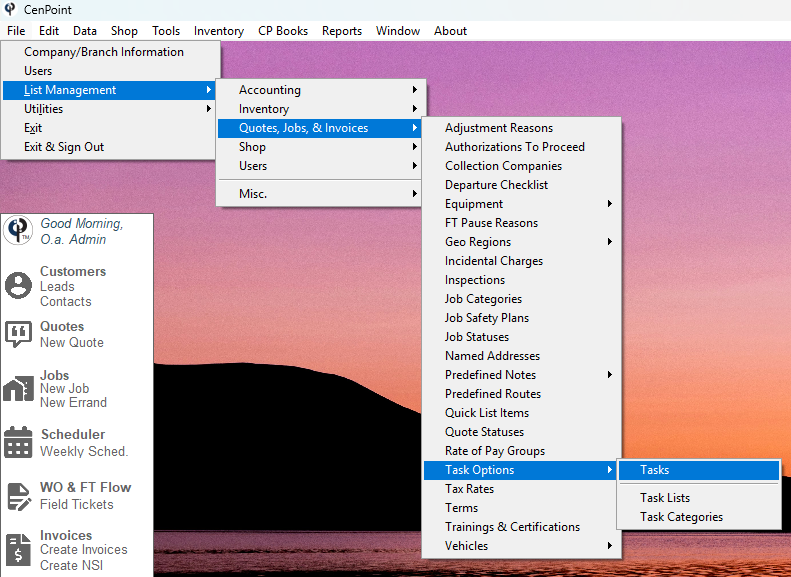

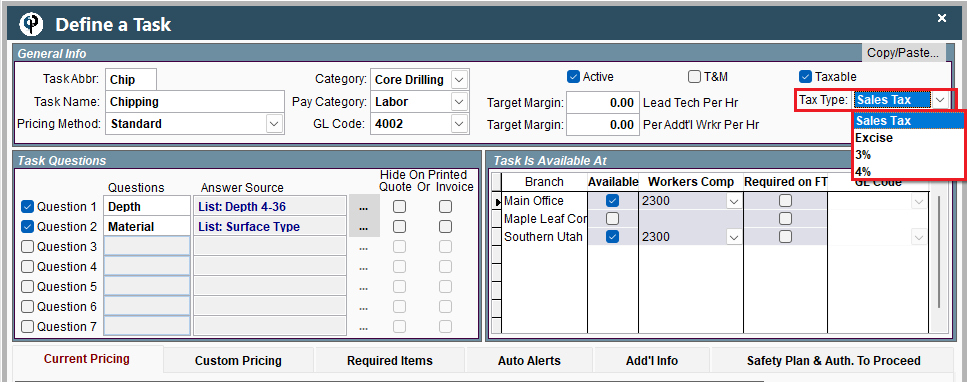

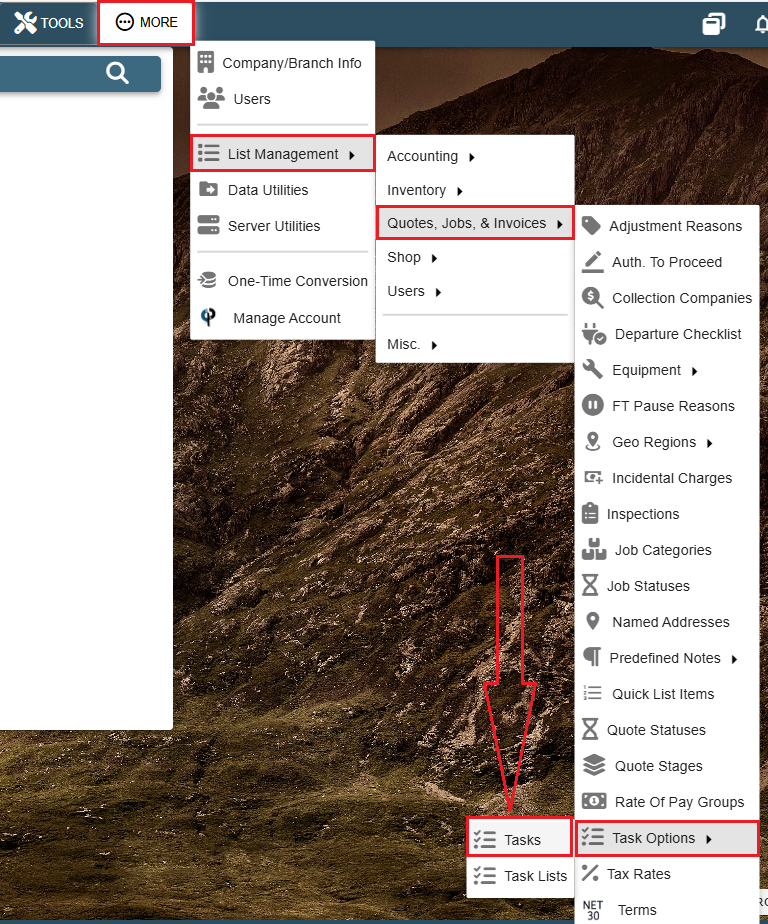

Mark a task always taxable by going to File -> List Management-> Quotes, Jobs, & Invoices -> Task Options -> Tasks

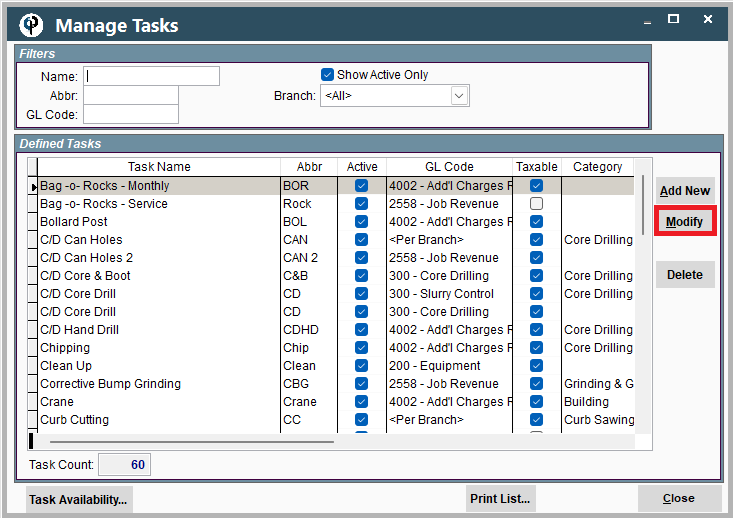

Find your task, highlight it, and click 'Modify'

Check the taxable box.

.png)

If you want a task marked as taxable ONLY FOR A SPECIFIC JOB:

Inside the Job, Select the Job Task and mark the Taxable box and fill in the tax rate.

.png)

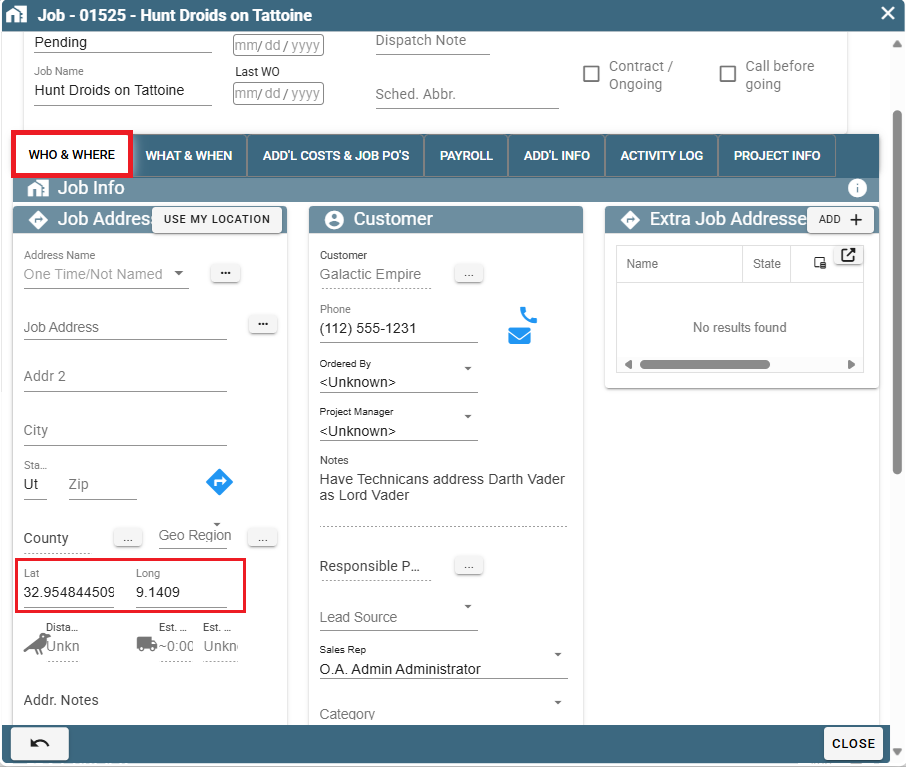

Job Address

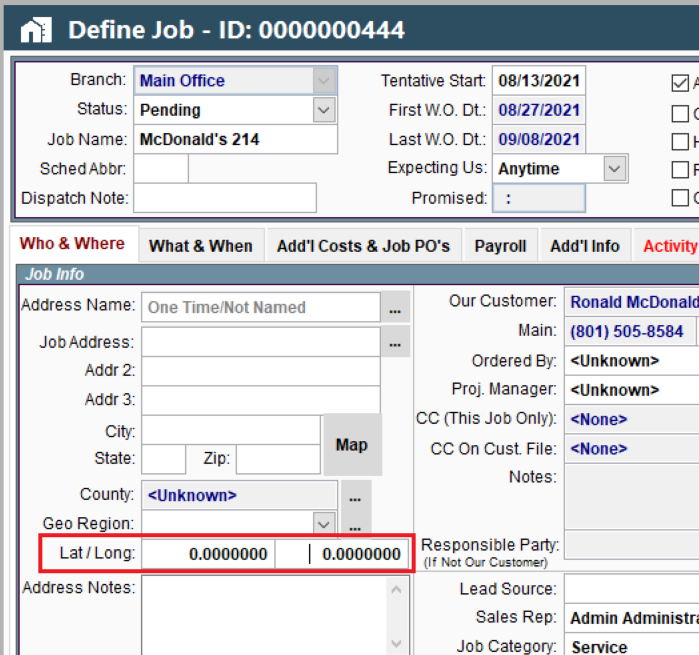

On the job if there is not an address, CenPoint does not know what rate to charge. To fix this either add an address that populates the latitude and longitude,

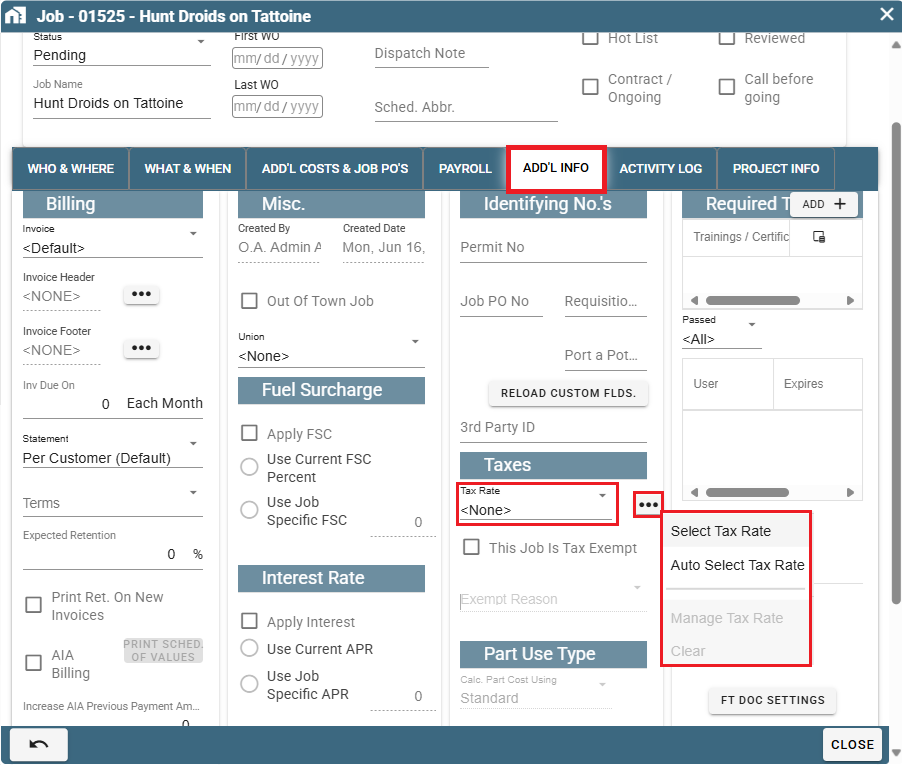

or under the Additional information tab on the job manually select the tax rate

Tax Region Defined Rate

Inside File -> List Management -> Accounting -> Tax Rates

Find your Tax Region and click 'Modify'. Then find the current effective Tax Rate and click 'Modify'.

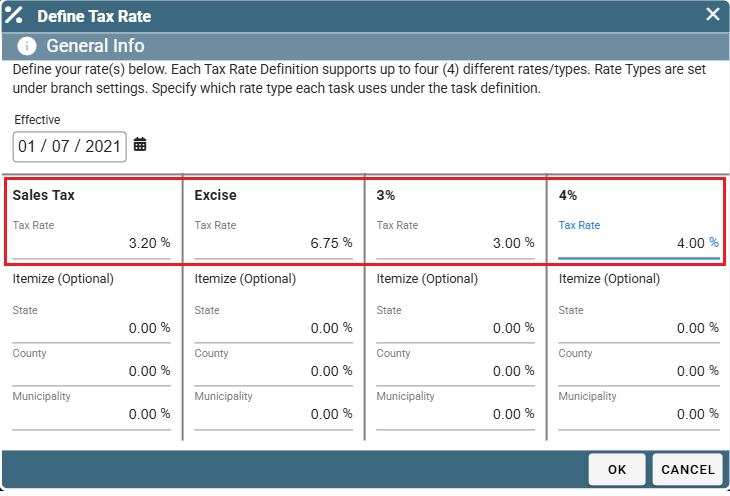

Make sure that the current effective Tax Rate(s) are defined.

This makes sure that the tax Type that the Task is assigned has a defined Tax Rate to calculate with.

See the following link for more information on how to set a Task's tax rate: Multiple Tax Rates/Types

Add Tax on the Invoice

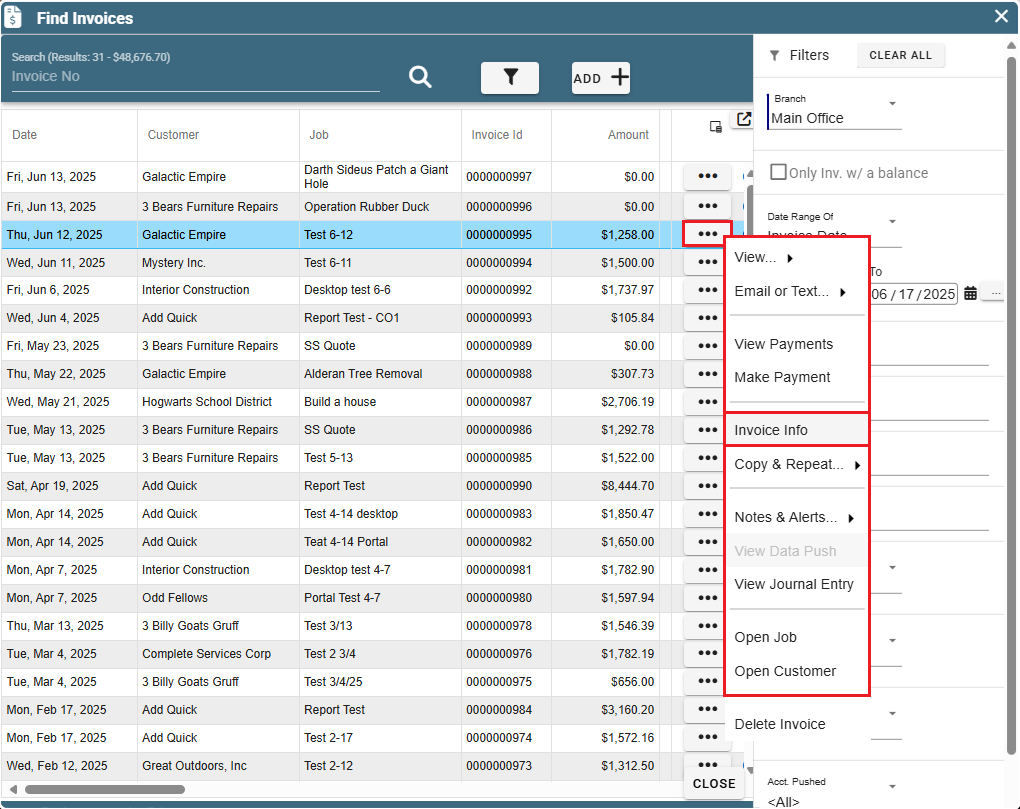

Go to the Invoice Info screen->Click the Ellipsis next to where the taxes are listed to Add or Remove Taxes.

Tax Rates on Portal

Tax rate by state, county, city on Portal

See the following link for more information on how to set up tax rates by State, County, and City: Tax Rates

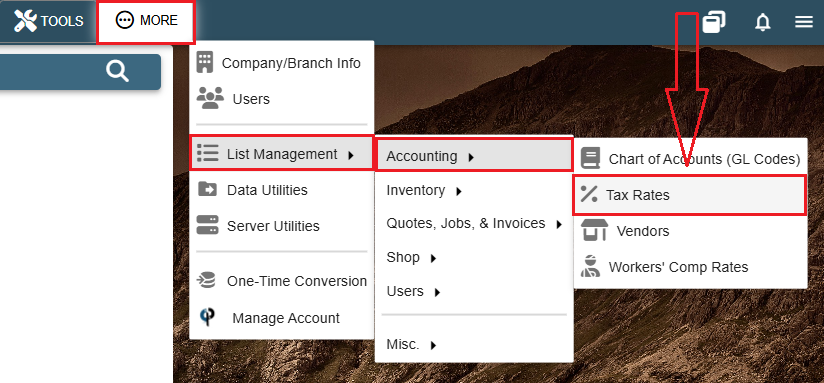

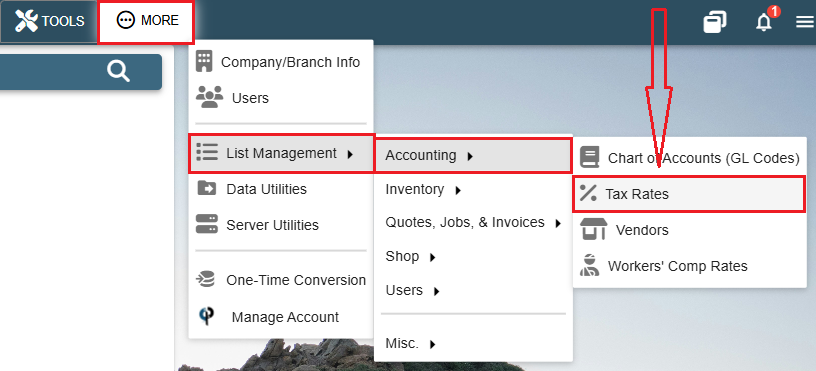

Go to More -> List Management -> Accounting -> Tax Rates

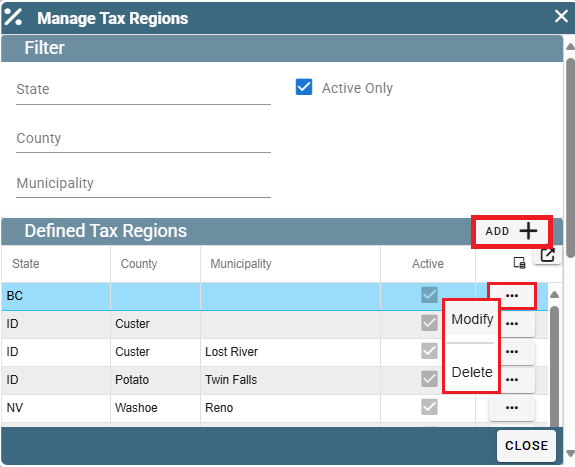

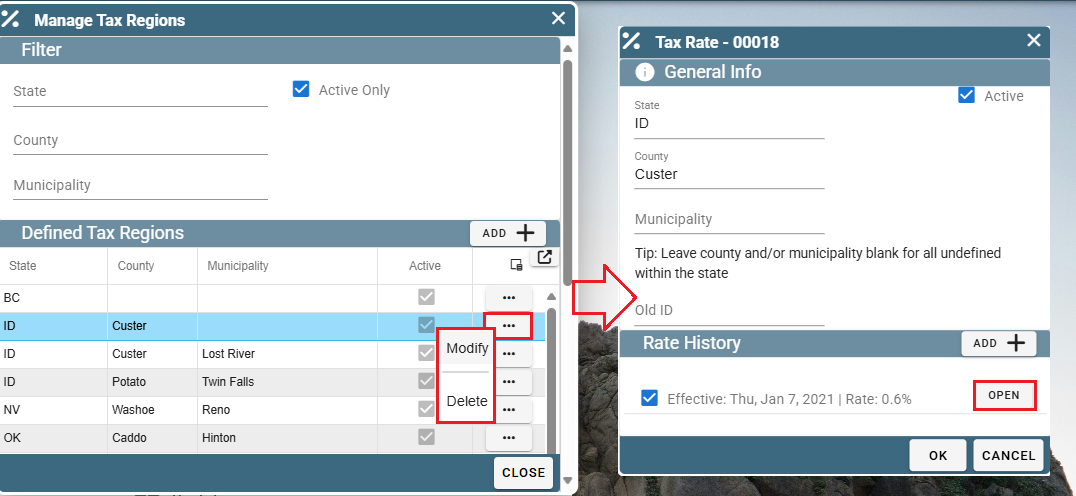

Use the 'Add', 'Modify', and 'Delete' buttons to edit your Tax rates based on Region.

Inside each region make sure to select an effective date and to add the tax rates.

Inside the Region click 'Add' to create a new tax rate.

Click 'Open' to edit an existing tax rate.

Please make sure all the tax rates are filled out so CenPoint can calculate taxes properly.

Enter in an "Effective" date to state when these rates will go into effect.

Delete Taxes on Portal

Taxes can be removed off a job on a Task by Task basis.

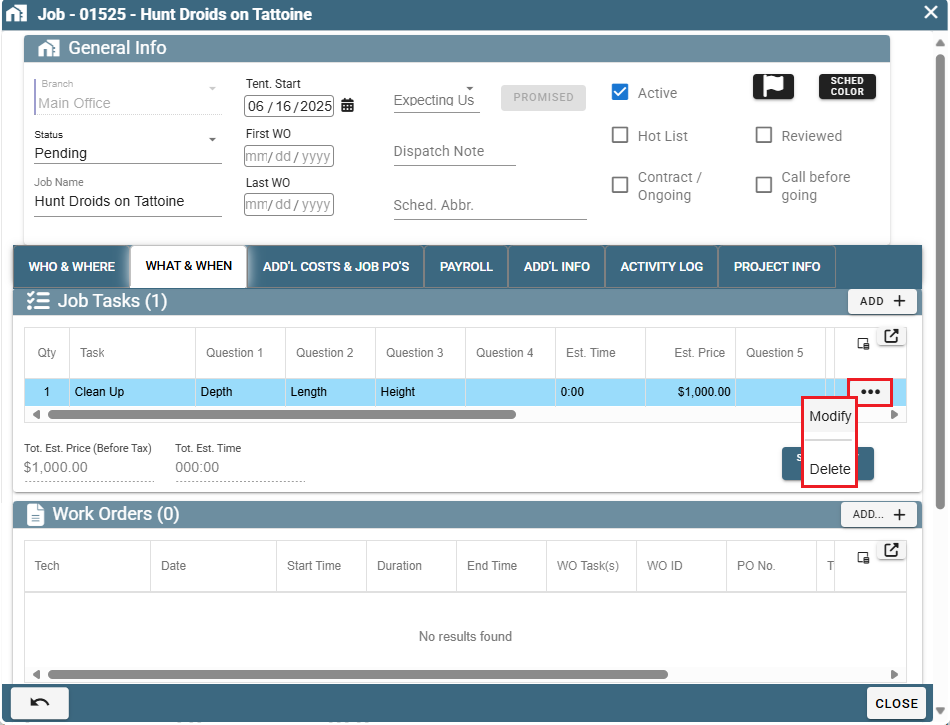

Inside the Job find the desired task and click the Ellipsis -> Modify

Inside the task uncheck the 'Taxable' box.

Find the invoice and click the Ellipsis -> Invoice Info.

Click the Ellipsis to the right of where the taxes are displayed to Add or Remove Taxes.

Missing Taxes on Portal

There are several different reasons that taxes may not appear on the job.

1. Customer is marked as Tax Exempt

2. Task assigned to a Job might not be marked as taxable

3. Job may not have an address

4. Tax Region may not have a defined tax rate for the tax rate the Task is assigned to.

If it is not one of the above-mentioned areas, you can still add tax from the Invoice Info window.

Information on how to do all of this is mentioned below.

Customer Marked as Tax Exempt

Check that your customer is not marked as Tax Exempt

Inside your customer go to the Misc. Tab and make sure the "Tax Exempt" checkbox is unmarked.

Task not marked as taxable

Mark a task as always taxable by going to File -> List Management -> Quotes, Jobs, & Invoices -> Task Options -> Tasks

Open the desired task and check the taxable box.

Job Address

On the job if there is not an address, CenPoint does not know what rate to charge. To fix this either add an address that populates the latitude and longitude,

or under the Additional information tab on the job manually select the tax rate

Tax Region Defined Rate

Inside More -> List Management -> Accounting -> Tax Rates

Find your Tax Region and click 'Modify'. Then find the current effective Tax Rate and click 'Open'.

Make sure that the current effective Tax Rate(s) are defined.

This makes sure that the tax Type that the Task is assigned has a defined Tax Rate to calculate with.

See the following link for more information on how to set a Task's tax rate: Multiple Tax Rates/Types

Add Tax on the Invoice

Go to the Invoice Info screen->Click the Ellipsis next to where the taxes are listed to Add or Remove Taxes.