Overview

CenPoint has integrated with Stripe to allow direct payment processing including ACH in CenPoint. To use these features, you must be set up with a Stripe. The following article will cover how to set up and accept electronic payments in CenPoint.

Stripe

Fees (Subject to Change)

No Setup Fees

No Monthly Fees

No Monthly Minimum

2.99% + $0.30/transaction (for all card types)

ACH (United States)

Fees (Subject to Change)

No Setup Fees

No Monthly Fees

No Monthly Minimum

1.6% (up to a max of $10.00)

Set up to receive Electronic Payments in CenPoint

Steps 1-3 on Desktop

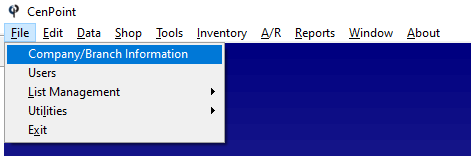

1. First go to File > Company/Branch Information.

2. Highlight your branch and click “Modify”.

(Each branch requires Electronic Payments set up)

3. Go to the Cust. Portal tab and click the checkbox “Accept Electronic Payments in CenPoint.

Select Stripe as your merchant and click Create Account/Authorize CenPoint..png)

Please scroll down to “Steps 4 to the End on Desktop and Portal” for further instructions.

Steps 1-3 on Portal

First go to More→ Company/Branch Information

.png)

click on the ellipsis by your branch and click Modify

.png)

Go to the Cust. Portal tab and click the checkbox “Accept Electronic Payments in CenPoint.

Select Stripe as your merchant and click Create Account/Authorize CenPoint.

.png)

Steps 4 to the End on Desktop and Portal

4. Go to the browser that launched

Scroll down to Locale and confirm your country has been selected.

We use your country to determine what currency should be used when processing a payment.

i.e. USA = US Dollars, Canada = Canadian Dollars, etc.

.jpg)

5. Scroll Down to Electronic Payments-> Check the Accept Electronic Payment->

Choose Stripe-> Click Create Account

You will be redirected to the Stripe webpage to create an account.

.jpg)

6. If you already have a branch authorized with a Stripe,

and the branches share the same bank account, you can select that branch and 'Copy' the authorization.

Otherwise, you will need to create a different Stripe account, so the payments go to the correct bank account.

.jpg)

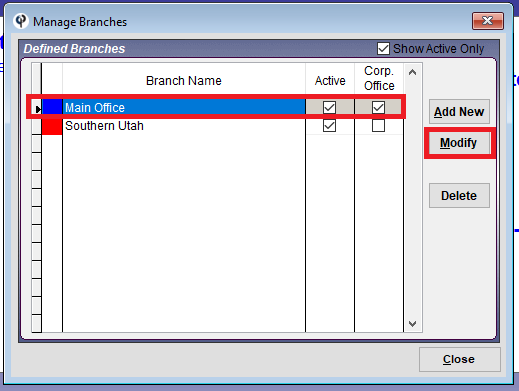

7. A browser will launch to this page, to allow CenPoint to connect with your Stripe account.

Click “Create Account/Authorize CenPoint” to proceed.

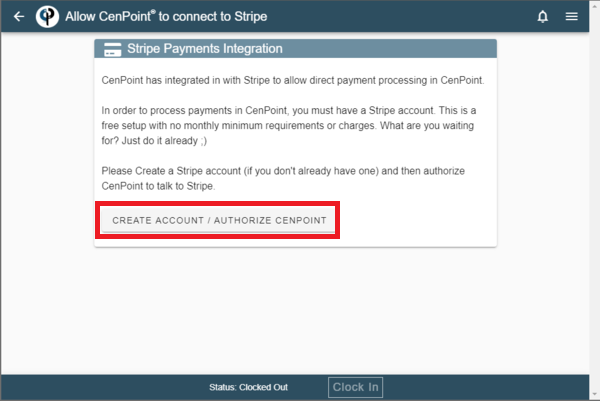

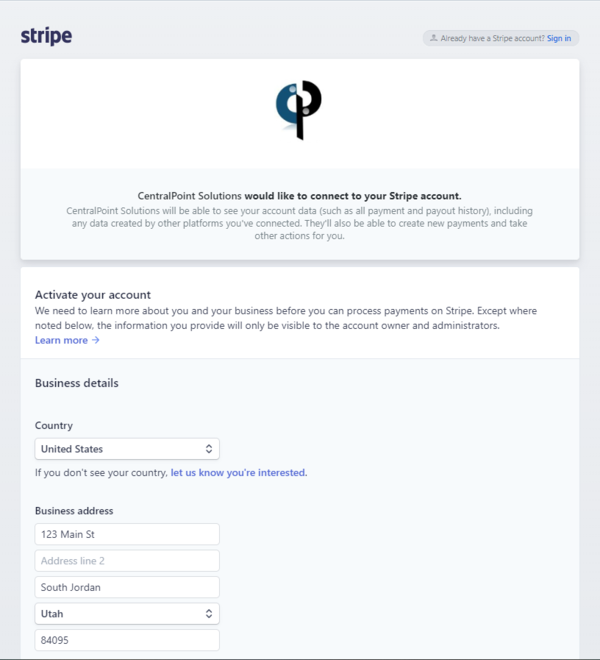

8. You will then be directed to the Stripe account you selected.

This screen will appear next. We auto populate as many fields as possible,

such as the business address. Fill out the remaining fields to finalize your Stripe account.

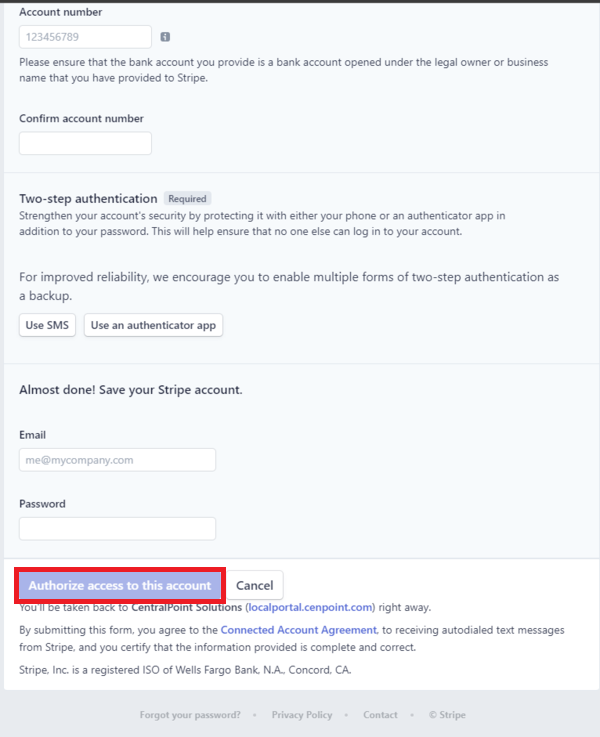

9. At the bottom of this form, after you have completed all required fields, click the “Authorize access to this account” button.

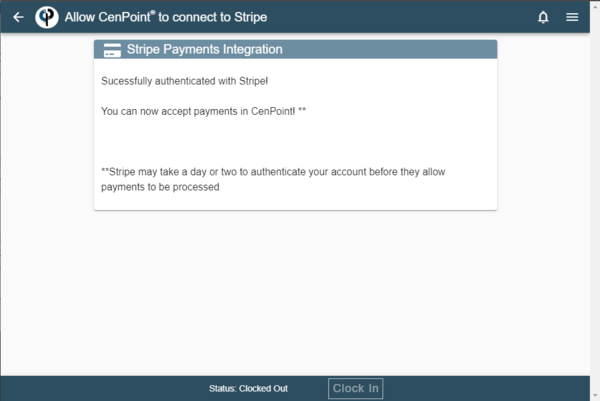

10. You will receive this verification message in a browser.

Congratulations, you are now set up to accept electronic payments CenPoint!

The next step is to set up the 'Fees' associated with taking electronic payments in CenPoint.

Use the following link for setting up Fees for electronic payments in CenPoint:

FAQ's

How are Fees paid to Stripe?

Stripe deposits the invoice amount minus the transaction fee into your account.

Example: Your invoice is for $100.00 there is a 3% transaction fee, $97.00 will be deposited into your account.

Example 2: Your invoice is for $100 you charge a 3% transaction fee to the customer, the invoice total is now $103, Stripe will deposit $100 into your account.

How long does it take to get a deposit from Stripe?

The first deposit from Stripe can take up to 10 days, subsequent deposits are usually around 2 days.

(You may not want to have your first deposit or charge from a customer be a large amount that you would have to float for 10 days.)

How is a Credit Card Charge with Fee's applied to and Invoice?

When the customer pays through the link and clicks the I understand that a processing fee will be added check box,

the invoice is then updated (changed in CenPoint)to include the fee. When you print the invoice there will be a line item showing the fee.

CenPoint now pushes the total with the fee to your accounting software.

* BUT... you have to reconcile your accounting software with the Stripe fees.

Example: Your invoice was $103 including the 3% Fee charged to the customer, CenPoint pushes the invoice of $103 to your accounting software.

At this point your bank statement and accounting software will not match. The bank statement says there was a $100 deposit, (because the Stripe fee was taken out)

Record the Credit Card Fees from Stripe to your accounting software and you're back in balance.

For information on how to record Stripe fees in your accounting software use the following link:

.png)

Who pays the EFT fees?

As of right now there is not a way to pass the EFT fee on to the customer. If your customer chooses to pay with an EFT payment you will cover the cost.